Deal activity still resilient in Asia-Pacific

Recent headlines such as “With M&A Hit, Wall Street Bankers Keep Busy With Stock Sales” (Bloomberg, 28 May), “Bankers fear sustained M&A slump: ‘It’s impossible without face-to-face meetings’” (Financial News, 8 June) and “Pandemic fears grip M&A as deal making slumps to 23-year low in Europe” (MarketWatch, 30 June) suggest a very depressed market for corporate transactions this year.

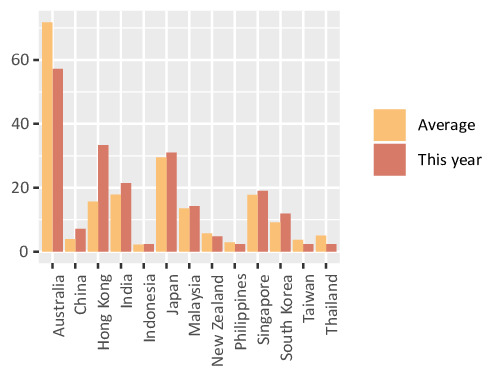

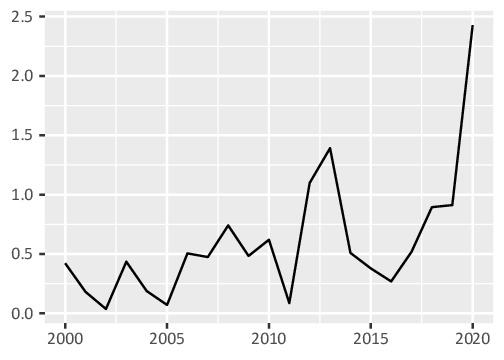

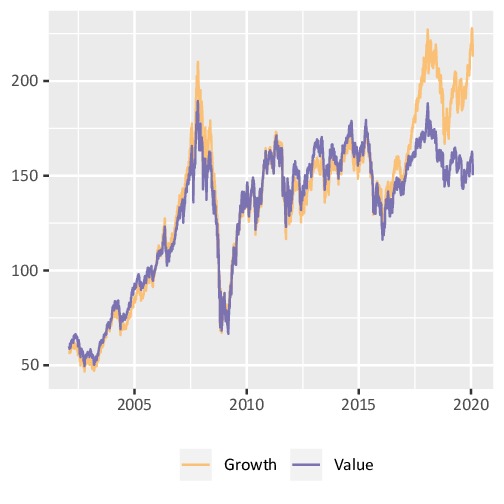

However, the numbers in Asia-Pacific tell a different story: (more…)