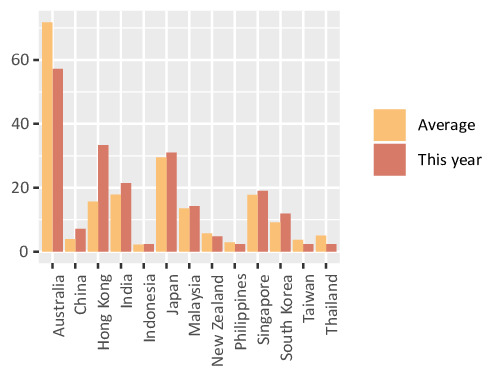

Transaction volumes continue to trend at high levels across the region. The chart below shows deal announcements this year (annualised) compared with the average since 2006:

One market stands out in particular: Hong Kong, with more than double the normal total. What is going on? We think two things:

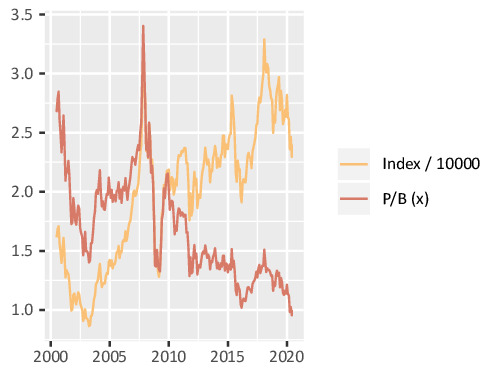

- Valuations: the market has fallen below book value for the first time in at least 20 years (figure below). This may be prompting companies to de-list with a view to achieving a higher valuation on another market.

- The imposition of the National Security Law has created political uncertainty, driving Hong Kong-incorporated listed companies to consider privatisation and re-incorporation elsewhere.

We think both factors should continue to drive healthy levels of deal activity in Hong Kong.

Recent deal breaks in ANZ and implications for completion rates

Of the 19 deals we tracked in Australia & New Zealand (ANZ) prior to the pandemic-related market sell-off, twelve failed and four completed – the rest are pending. Of the failures (which were in nearly all cases caused by bidders unilaterally walking away) only one target – Metlifecare Limited in New Zealand – is actually standing up for shareholders by giving them a vote on whether to take the bidder to court. The others have all essentially thrown in the towel.

This outcome was unexpected, and from it we draw the following conclusions:

- We expect Material Adverse Change (MAC) clauses to be revamped to include more explicit seller / target protection. We saw the first evidence of this in a takeover in Australia just announced on publication date, where the language excludes “any pandemic or escalation of the same“.

- Bidders who unjustifiably renege on legally binding takeover agreements damage their long-term reputations and will find themselves disadvantaged in future deals. This will affect their access to due diligence and it will affect deal pricing.

- At the same time, shareholders of targets must hold directors to account if they allow bidders to walk away without consequence. At the very least, shareholders must be allowed to vote on taking further action, as in the Metlifecare situation.

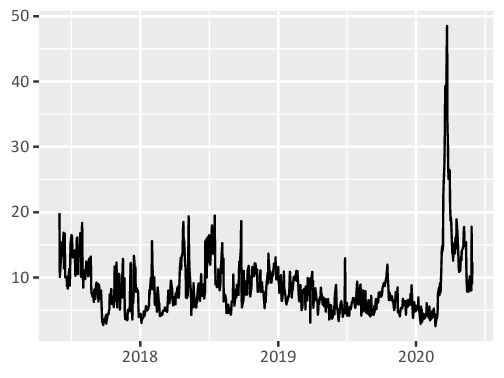

For the reasons above and also as laid out in our April newsletter, we believe that deal completion rates will continue to trend higher from here. When combined with the high level of activity (in Hong Kong and elsewhere), and attractive annualised returns on offer (shown below), we view this as a good environment for investing in the Asia-Pacific M&A space.

Annualised return offered by Asia-Pacific M&A deal universe (%). Source: Metrica. Includes all deals followed by Metrica with positive spread.