The Covid-19 crisis has created a perfect storm for global M&A:

- Earnings are falling precipitously. Acquirers are calling off deals by invoking Material Adverse Change (MAC) clauses. Many transactions have either broken or widened out to spreads of 30% to 70%.

- Even less-risky deals are seeing much wider spreads due to forced de-leveraging. For example, we saw annualised returns in Japan which have been around 2-3% for months blow out to 40%+ at one point.

The disruption in the M&A space has been more severe than during the GFC, as this time the correction has been stunningly abrupt.

New Zealand was the worst affected. Of three M&A deals at the start of the month, two suffered deal breaks and the third is effectively broken, ending the month at a very wide discount to terms. New Zealand has so far imposed the most restrictive lock-down in Asia-Pacific, with the entire economy shut down for a month.

We have been disappointed that some acquisition targets have meekly accepted bidders’ use of MACs to abandon deals, without offering any resistance. Historically, MAC clauses have typically been used to protect against company-specific events rather than general economic disruption. Indeed, one of the recent failed deals had an agreement that specifically excluded MACs due to “changes in general economic or political conditions”.

Event-driven strategy outlook

Low-downside deals now offer highly attractive annualised returns – in many cases exceeding 10% – and we have been adding exposure.

We expect annualised returns from safer deals to remain high for some time, as we have been seeing investors allocating away from risk arb into higher beta strategies.

Completion rates should remain lower than average for seasoned (announced pre-COVID-19) deals but will be higher than average for newly-announced deals which will include more seller protection clauses specifically excluding virus-related disruption.

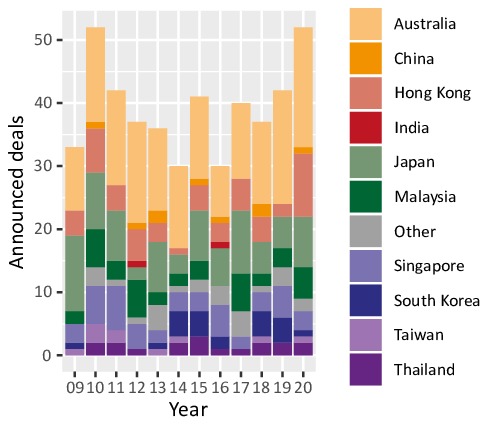

Although year-to-date announced M&A is still in-line with the post-GFC record (figure below), activity has started to slow, with the number of “live” (announced and not yet completed) deals in Asia-Pacific falling to just 53 at the end of the month, versus 80 at the end of February.

We expect activity to be slow for a while. M&A volumes didn’t fall much during the GFC, but this time is clearly different, with substantial logistical barriers in place making it harder to conduct due diligence or to execute transactions.

Combined daily turnover is $543 million. Hong Kong is still a relative bright spot, with huge interest from major or founding shareholders seeking to privatise companies on the cheap (e.g. the Li & Fung transaction just announced).

Value continues to underperform

Value had been under-performing during the bull market as we wrote about in our January newsletter, this trend has accelerated during the recent correction – causing the value factor to under-perform even more during March.

This phenomenon has been widely covered in broker research and in the financial press (e.g. see John Authers’ columns on Bloomberg). It is somewhat surprising that a trend which has lasted for the entire duration of the post-GFC rising market has so far continued into the sell-off.

We don’t expect this to persist though. One feature of the current market is that it is behaving quite differently from the “risk-on / risk-off” pattern we saw during the GFC, where on any given day everything was either up together or down together.

This time, individual markets have shown very wide variations in day-to-day performance, and the same is true of sectors. We have already seen some very wide moves in individual spreads – e.g. intra-month we saw some Malaysian discounts widen to 89% – on days when other positions were moving in the other direction.

We have seen arguments that value stocks should be under-performing as they include a lot of smaller, more leveraged names which will be more exposed to an economic downturn.

Nevertheless, it was encouraging to see the Wheelock spin-off which is explicitly targeted at eliminating a holding company discount. Similarly, the Li & Fung takeover – while admittedly not involving a holding company – is another example of founding / major shareholders taking advantage of extremely depressed valuations. We expect to see more cases during the current turbulence.