Relative value is a strategy that has, over the years that we have followed it starting in 2007, generally performed well and has produced returns uncorrelated with other strategies and with the broader market. However in last two years the strategy has started to perform poorly for investors. What is the cause?

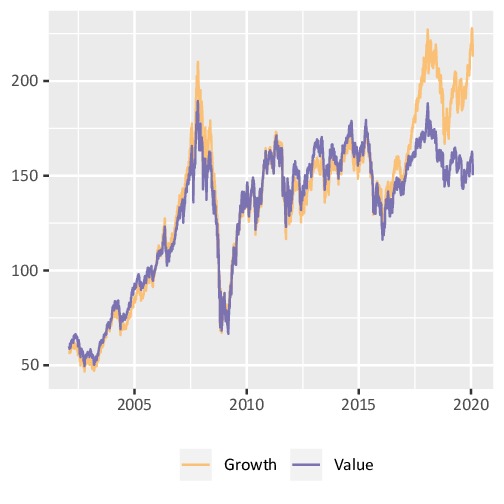

The figure below shows is an 18-year chart of the MSCI AC Asia ex-Japan Growth and Value indices. Growth tracked Value very closely over the entire period up to 2017. Since then, Growth has significantly outperformed.

Why is this? Thinking in terms of a discounted cash-flow (DCF) model, growth stocks are long-duration assets which derive most of their worth from the terminal value component of the DCF, rather than from current net assets as in the case of value stocks. In turn, terminal value depends on interest rates and the level of future earnings.

The chart tells us that, since 2017, Asia-Pacific markets have started to price in either a significant further fall in interest rates (even with rates at historical lows) or a substantial improvement in earnings (even after a very extended period of global economic growth). Both scenarios seem unlikely to us.

So two questions: 1) given the broader macro picture of growth outperforming value, what types of relative value investment strategies are still attractive? and 2) what are the prospects from here on?

Why invest in RV

Although over the past few years, almost any hedge fund strategy has both underperformed and been more volatile than a simple buy-and-hold of equity market index funds, we don’t expect this situation to continue forever. A RV strategy is an important component of a investor’s portfolio for protecting against inevitable down markets. By having a net delta close to zero, an RV strategy produces over time positive returns that do not depend on the market’s direction.

However, successfully executing a RV strategy means being prepared for periods of spread widening and being in a position to take advantage of them.

In our view, a purely quantitative-style factor-driven strategy – for example, buying low P/B and selling high P/B stocks – is exposed to significant downside in the sense that there is no natural constraint on how much the spread between the two groups can widen.

A case in point is the seemingly inexorable out-performance of Alphabet, Amazon, Google etc. over the last six years versus the rest of the market.

Contrast that with an RV strategy such as holding company trading. Trade construction here involves being effectively long and short stocks with exposure to the same underlying earnings. What is good for the long side should also be good for the short side, and vice versa.

This provides a much tighter linkage between the two sides of the portfolio, similar to an elastic band – the more it is stretched, the greater the force acting to pull it back together.

We think this makes tailored RV strategies such as the above a much better prospect than the more simplistic alternatives based on quantitative factors.

Prospects

Turning to our second question – the prospects for this strategy. Three points here:

- Sell-side analysts are starting to call for a shift from growth to value. Morgan Stanley’s global strategy team recently declared that “a secular rotation from Growth to Value is beginning” (“Value Over Growth: A Recession Could Trigger a Secular Shift”, 14 November 2019) and that “Value’s performance relative to Growth is bottoming after 13 years of under performance… the current late-cycle environment isn’t likely to last forever, and we believe that investors should look ahead to the coming regime shift”.

- Hedge fund positioning is crowded in favour of growth. According to Morgan Stanley’s Prime Brokerage Strategic Content team (“Hot Start, Peak Gross… Should we be Concerned Yet?”, 16 January 2020), hedge fund net exposure to growth versus value is at its 93rd percentile since 2015 – and when limited to the key sectors of Tech, Consumer Discretionary and Communications Services – is at its 100th percentile since 2015.

- More specifically, additional value can be added through constructive engagement with portfolio companies – an avenue not available to quantitative managers.