The twin themes

In Korea, it was good to see the second set of amendments to the Commercial Act passed on 25 August. Listed companies with assets exceeding two trillion won will now have to adopt cumulative voting, making it dramatically easier for minority shareholders to get at least one candidate onto the board.

The next set of amendments to the Commercial Act, scheduled for later this year, will include the mandatory cancellation of treasury shares.

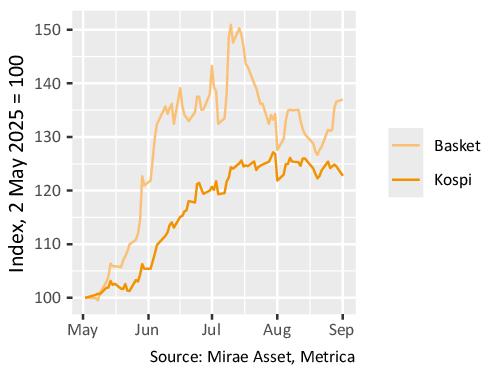

Treasury shares have been a focus topic in the Korean market since Lee Jae Myung initiated his presidential campaign, with a basket of treasury share-heavy holding companies beating the index by around 25% at one point (figure below).

Performance of a basket of holding companies with large treasury share holdings, May 2025 to present

The reason is that, in the past, treasury shares have often been misused to defend management rights against hostile takeovers or shareholder activism. Consequently, the ruling Democratic Party of Korea is proposing that companies must cancel their treasury shares within a certain timeframe, which has not been determined yet but is likely to be immediate to one year for newly-acquired treasury shares, and six months to five years for existing holdings.

Korea’s business community has inevitably voiced strong opposition to these measures, arguing that treasury shares are a strategic tool for defending management control, such that rapidly cancelling decades’ worth of accumulated shares would be not only impractical but would also leave companies exposed to foreign hostile takeovers.

Given the progress made to date on other reform measures, Metrica is reasonably confident that the government will be able to push through the treasury share cancellation bill with timeframes on the shorter end. This will improve transparency in the market and reduce the ability of companies to use treasury shares for illegitimate purposes.

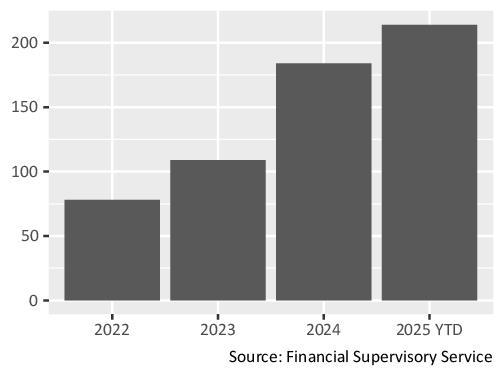

Some companies have already been ramping up cancellations (figure below), spurred by the “Value-up” initiatives of former President Yoon and an increased focus on corporate governance by domestic investors.

Treasury share cancellation announcements by listed firms in South Korea

Taking care of business

Korea’s President Lee is a month into his term, and so far he has remained admirably focused on promoting the “KOSPI 5000” agenda.

A long-awaited bill to reform the Commercial Act just passed the National Assembly as this newsletter went to print, and it includes provisions expanding the duty of care of corporate directors from “companies” to “companies and shareholders”, mandating electronic general shareholder meetings for large companies and limiting the voting rights of shareholders and related parties to 3% when electing audit committee members.

By implementing these reforms, the government is acting against the express wishes of the chaebols, who have campaigned loudly against them. It is strong evidence that the incoming administration is able to get things done. It also reflects recognition that, with almost a third of Korean people having brokerage accounts, anyone threatening to derail the stock market’s 30% year-to-date rally would be playing a dangerous game.

Taxes are another area of focus. Following the discussions on inheritance tax changes for listed shares – outlined in last month’s newsletter – the government is turning its attention to dividends.

Currently, all financial income including dividend income is taxed at 15.4% below KRW 20 million, and at progressive rates of up to 49.5% above KRW 20 million. The National Planning Committee and Ministry of Economy and Finance are considering eliminating the progressive rate schedule so that everything is taxed at 15.4%.

Historically, chaebols have been reluctant to pay anything more than nominal dividends to their owners due to the high tax burden. If President Lee’s dividend tax reform goes ahead, it should encourage operating subsidiaries to raise payouts, which would be positive for the valuations of the listed holding companies that own them.

Japanese MBOs and parent-subsidiary listings

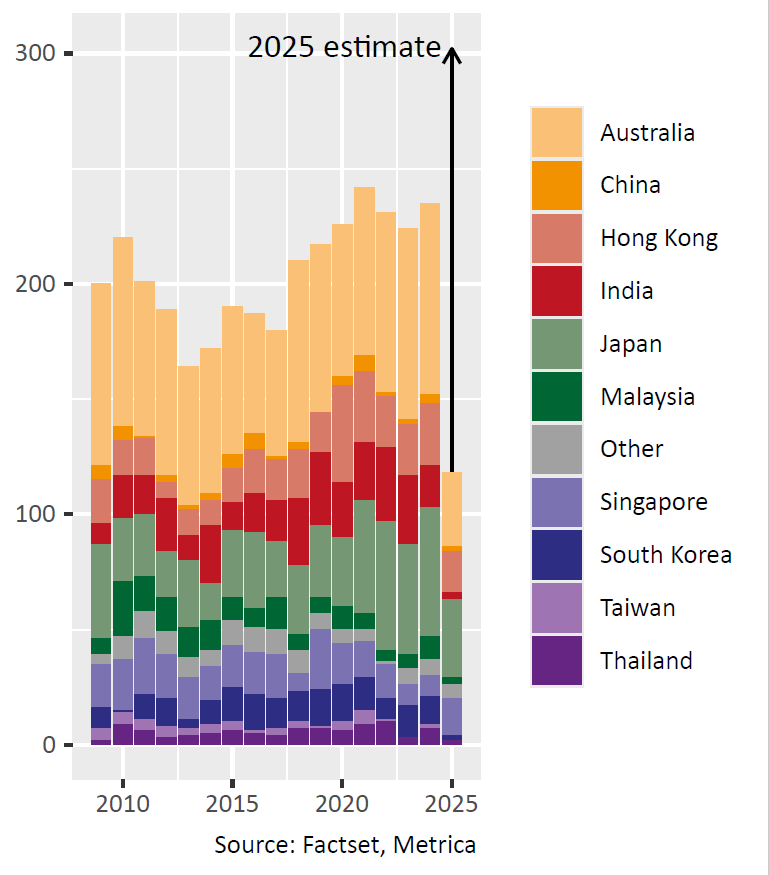

It is proving to be a very busy year for Asia-Pacific M&A, with the number of deals on track to exceed 300, comfortably exceeding the previous peak of 242 (figure below). Hong Kong, Singapore and Japan have shown the greatest leaps in activity, with run rates of 3.5x, 3.0x and 2.1x the post-2009 average, respectively.

Announced M&A deals with target listed in Asia-Pacific, 2009 to present

Japan remains an area of particular interest. This year’s surge in dealmaking seems mostly driven by two Tokyo Stock Exchange initiatives:

- In February the exchange published a presentation containing views sharply critical of listed parent-subsidiary structures8. Since then at least $50 billion of clean-up transactions have been announced, including NTT / NTT Data, Toyota Industries / Toyota Motor, KDDI / Kyocera and Aeon / Aeon Mall. Japan still has more than 200 listed subsidiaries9 so there is plenty more to be done on this front.

- Next month the exchange will significantly tighten protections for minority investors in going-private deals10. A broader range of deals will now be caught by the requirement to obtain a special committee (SC) opinion. The SC will now have to consider whether any increase in corporate value will be fairly distributed to minority shareholders. The new rules also require greater transparency for any valuations performed in the analysis.

Some acquirers are clearly taking advantage of the rush to get deals done at very low prices, and a number of these situations offer interesting optionality, according to Metrica’s analysis.

Election result

The result of the Korean presidential election came in just as this newsletter went to press. Metrica was pleased to see Lee Jae-myung win the race by a comfortable margin. Mr. Lee’s campaign platform included a large number of pledges to improve Korea’s corporate governance and stock market functioning, including:

- Improving corporate governance transparency

- Revising the commercial act to expand corporate directors’ fiduciary duties beyond the company to include shareholders

- Ensuring that cumulative voting cannot be excluded by the articles of incorporation

- Ensuring that new shares are allocated to existing parent company shareholders (including minority shareholders) in the event of a split-off listing

- Implementing policies which institutionalise the mandatory cancellation of treasury stocks by listed companies, ensuring these shares are returned to shareholders as a benefit

- Setting a mandatory independent director ratio for companies of a certain scale, ensuring certain level of independent oversight

- Gradually expanding the separate election of audit committee members for large listed companies

- Implementing electronic voting for large listed companies

- Introducing of advisory shareholder proposals

- Implementing fair price framework that considers stock prices, asset values, and revenue values when determining the acquisition or merger prices for publicly listed companies

- Implementing mandatory public purchases to share management control premiums and guarantee opportunities for minority shareholders to redeem their shares during company acquisitions

- Implementing system allowing minority shareholders to request an examiner through the courts when merging publicly listed companies and their affiliates

- Strengthening monitoring and sanctions against unfair internal transactions Importantly, Korea finally has a president and majority government from the same party. For the first time in three years, the government will be able to progress its legislative agenda without being constantly hindered by an uncooperative veto-holder.

0.8x

A bill submitted by Korea’s ruling Democratic Progressive Party with the firm support of the incoming president could have a significant impact on the valuations of certain listed companies.

It seeks to remove the incentive for major shareholders deliberately to depress their companies’ share prices around succession events.

Currently, inheritance tax for listed companies is calculated using a four-month average of the share price around the time of the transfer. This has led to companies conducting deeply-discounted rights issues, intra-group transactions or mispriced mergers, intending to drive the price down and thereby minimize inheritance taxes.

By contrast, for unlisted companies, inheritance tax is determined using a blended average of earnings value and net asset value. If the blended average amounts to less than 0.8x net asset value (NAV), then 0.8x NAV is used as the floor valuation.

The proposed bill would apply the unlisted company formula to listed companies in cases where the listed company’s shares are valued at less than 0.8x NAV.

At the same time, for companies trading above 0.8x NAV, a 20% surtax for controlling shareholders would be removed and it would also become possible to pay the tax bill in stock rather than just cash.

In Metrica’s view, the heavy burden of inheritance taxes is a primary cause of the “Korea discount”, depressing valuations for the whole market but particularly for conglomerates, which have reached valuations as low as 0.2x or 0.3x NAV. So to the extent that this bill succeeds, it could create a very powerful rally in the affected names.