A pathway to stability

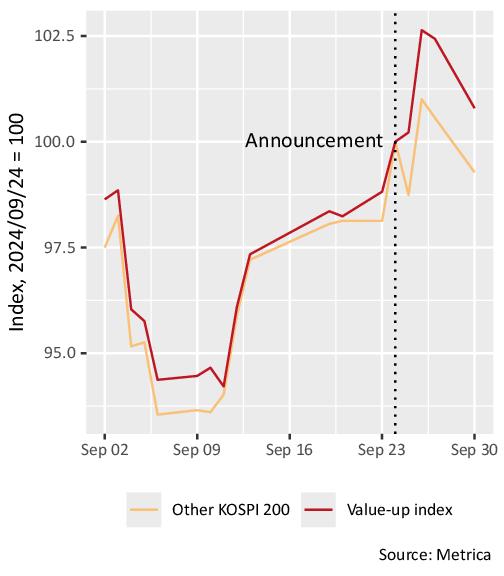

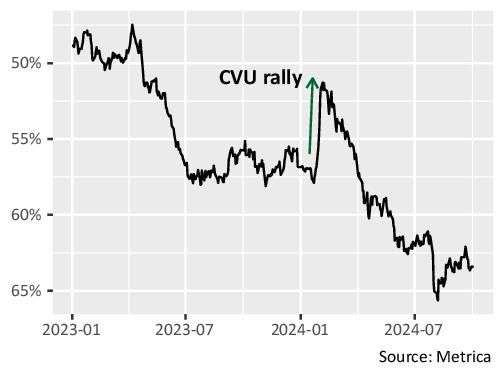

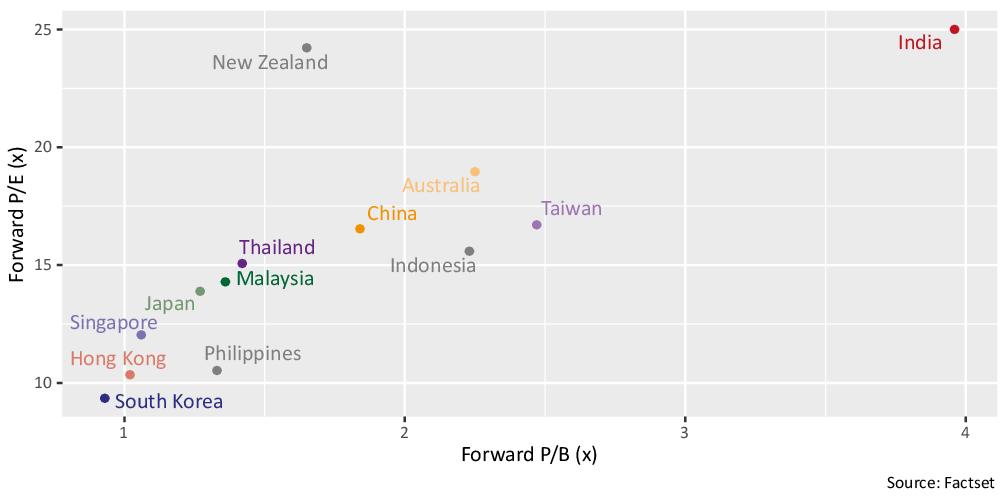

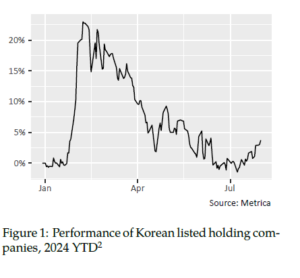

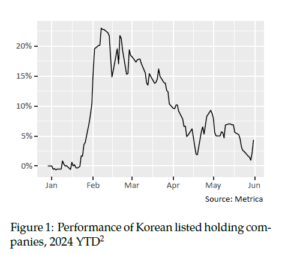

The long-awaited impeachment trial verdict in Korea is due the day after this newsletter goes to press. If the impeachment is upheld, a presidential election must be held within sixty days. A victory for the opposition candidate Lee Jae-myung, who narrowly lost to President Yoon in the last election, would have positive implications for the market, as it would allow the Democratic Party of Korea (DPK) to push through its corporate governance reform agenda unhindered. Conversely, a continuation of the status quo whereby the People Power Party holds the presidency and the DPK controls the National Assembly would be less favourable, as it would prolong the political stalemate. Even so, much progress was made on Yoon’s “Corporate Value-up” initiative in 2024 under essentially the same structure, and we would expect the governance reform momentum to continue in any case. It is worth remembering that Japan was able to achieve significant progress towards the same goals through non-legislative measures.