We continue to have a strong conviction in a strategy of buying companies at 80-90% discount to NAV, with an expectation of a catalyst for value realisation.

While over the long-term this has proven to be a very effective strategy, it has performed poorly over the past year.

What could be the cause? We believe the global underperformance of the value factor is the main culprit.

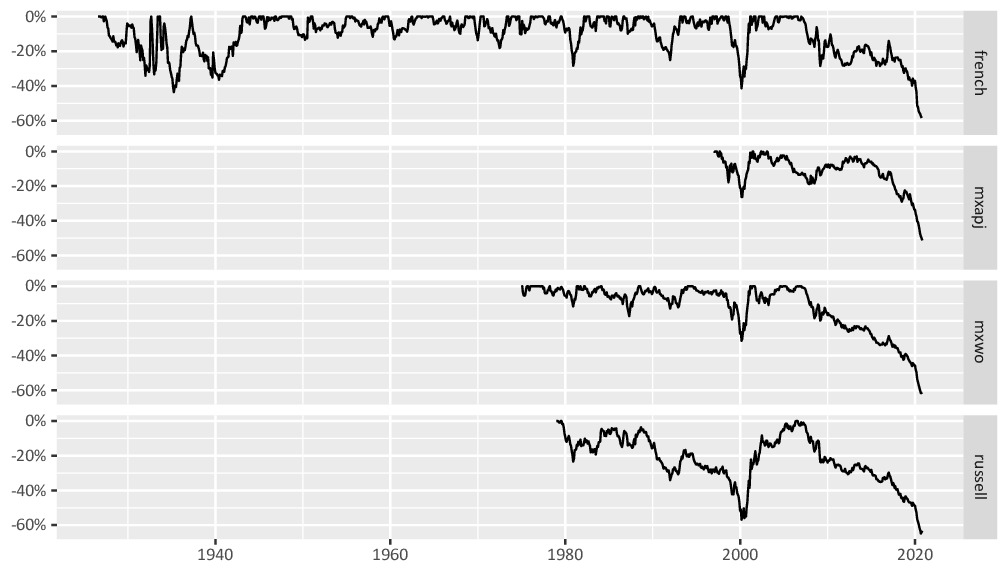

We have previously illustrated this using benchmarks from MSCI and Russell Investments. However, to show just how extreme the current moves are, we have added a dataset from Professor Kenneth R. French of Dartmouth College which goes back to 1926. The current drawdown approaches 60% which is the highest ever for all four of the benchmarks. The duration of the drawdown approaches 14 years which is the longest ever:

In addition, for three of the indices this year has seen the longest unbroken stretch of underperformance in history of 11 – 13 months with no upticks:

| Index | Months | Start | End |

|---|---|---|---|

| french | 12 | Jan 2007 | Dec 2007 |

| mxapj | 13 | Oct 2019 | Oct 2020 |

| mxwo | 11 | Oct 2019 | Aug 2020 |

| russell | 11 | Oct 2019 | Aug 2020 |

Furthermore, the severity of this year’s move has also been exceptional. Using the Kenneth R. French dataset, the underperformance in the nine months up to September 2020 alone is already worse than any full year since 1926 – despite being only a nine month period.

So why does value continue to perform so poorly? Some explanations:

- In an environment of low growth and low inflation, earnings growth is scarce, so the market assigns a premium to companies which are still able to demonstrate growth, particularly if it is tied to a structural trend such as the shift to working from home.

- Growth stocks are long-duration assets as most of their value is made up of discounted future cash flows, which are expected to rise substantially. This means the discount rate is a key driver of valuations, and hence the current environment of low interest rates for the foreseeable future is a major positive.

- Growth stocks are actually growing at the expense of value stocks – e.g. in the case of fintech companies taking share from banks, or online retailers disrupting physical retailers.

- Investor appetite for IPOs of growth companies is very strong, driving up valuations.

We see merit in the above arguments, and we believe they explain the depressed valuations of not just value stocks but more specifically holding companies in Asia-Pacific, as:

- The underlying subsidiaries are typically high growth.

- Subsidiaries pay dividends and parents often don’t, which disadvantages the latter in a yield-seeking environment.

- The market premium for liquidity and large market cap is expanding, which benefits subsidiaries.

- Holding companies are not covered by analysts and their intrinsic value is not widely appreciated.

- Engaging with companies takes time and effort and many investors would rather spend the time angling for an allocation of the latest tech IPO.

Despite the strong headwinds to value, we don’t believe it would make sense to adopt a reverse strategy of short-selling names trading at 80-90% discount to NAV and going long names trading at large premiums to NAV.

In fact, we see several scenarios where the underperformance of value could reverse from here:

- An upward surprise in economic growth, causing a rise in interest rates.

- Regulators taking action to limit the supra-normal profits enjoyed by the largest tech companies which have in effect achieved oligopoly status.

- Growth companies over-investing and depressing future returns.

- Value stocks becoming so cheap and growth stocks so expensive that the trend naturally mean-reverts even in the absence of a specific catalyst.

We think downside from here is limited. Therefore we will continue to add to select names, rebalance where appropriate and continue engaging with select companies to generate catalysts for value realisation.