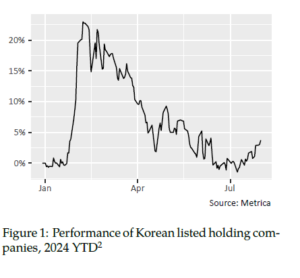

Korea stewardship code

In line with our continued commitment to the Asian markets and our dedication to fulfilling our stewardship responsibilities, we have initiated the process of registering Metrica as a participant in the Korea Stewardship Code.

For further details, please refer to the following disclosure link here.