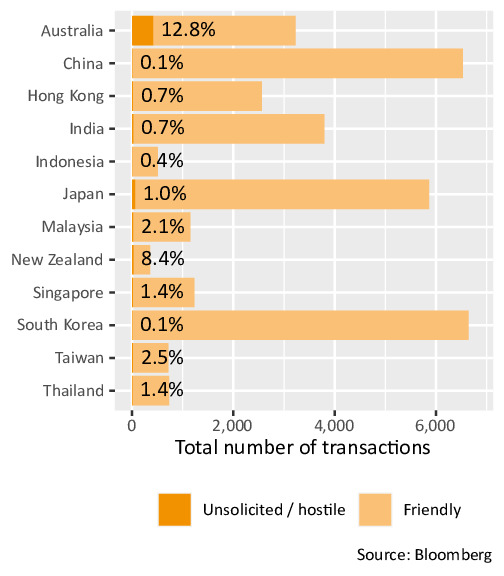

Unsolicited and / or hostile tender offers are rare in Asia-Pacific and particularly so in Korea – it ties with China in having the lowest proportion of such transactions (around one in a thousand according to Bloomberg); Australia by contrast has the highest with 12.8% (figure below).

The reasons for the scarcity in Korea are well-known:

- the market is still dominated by the chaebol groups which have strong links with the government and with financial institutions;

- cross-shareholdings are prevalent, raising the bar to gaining corporate control;

- corporate governance is frequently lacking, with board members appointed by controlling families, making it hard to challenge management; and

- cultural norms which emphasise harmonious business relations cast a negative light on disruptive takeovers.

In this particular situation, the company in question (SM Entertainment) is undergoing a dispute between the founder — since retired but until recently the largest shareholder — and his nephew, who is the current co-CEO. The nephew arranged a share placement to Kakao (an internet company with a media subsidiary) to weaken his uncle’s influence on SM Entertainment. This so displeased the uncle that he sold his 15% stake to SM’s biggest rival HYBE. HYBE then offered to buy another 25% of SM in the market. The target company has since mounted a vigorous defence via promises of higher dividends, share buybacks and new business opportunities. At the same time, a domestic activist investor who campaigned for better corporate governance at SM recently succeeded in getting its representative onto the board with only a 1% stake.

The situation is quite unique and probably doesn’t signal the start of a wave of hostile takeovers in Korea (and surprisingly, HYBE has denied that its partial offer was even hostile.) Nevertheless, we believe that the deal is further evidence of the increasing spotlight on corporate governance in the country, fuelled by an expanding base of activism-minded domestic investors. In this respect we believe Korea represents an interesting opportunity relative to markets such as Japan which started down the same road several years earlier.