The start of the year has already brought five $100 million-plus Japanese takeovers, representing a decade-plus high for the month of January. It contrasts with a 36% year-on-year slowdown in global M&A. What is behind the uptick?

One possible factor: the upcoming transition at the Bank of Japan. The announcement regarding Kuroda’s successor is expected as soon as February, and whoever it is may finally call a halt to the country’s ultra-loose monetary policy.

With this in mind, it is likely that investment bankers are rushing through as many deals as possible before the era of virtually-free yen financing comes to an end.

Commercial banks (mainly, the three megabanks) are happy to facilitate the rush. With demand for traditional corporate loans still nowhere near enough to absorb their massive deposit bases, banks must make up the difference with alternative sources of yield.

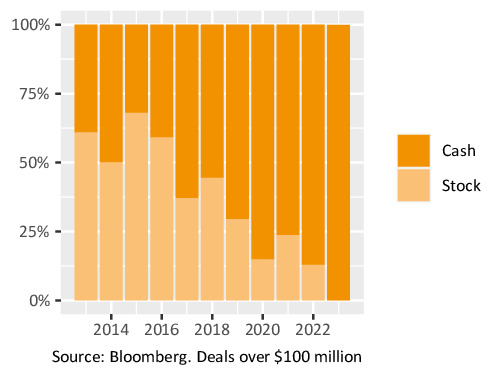

Acquisition finance fits the bill nicely as it is yen-denominated and secured while offering attractive returns versus government bonds, particularly in larger transactions with mezzanine tranches (which are entirely bank-financed in Japan in contrast to other countries). It is not surprising that, in recent years, cash has almost wholly replaced stock as an acquisition currency (figure 1).

Figure 1: Payment for Japanese takeovers

Succession remains a key driver of activity. Over 64% of Japan’s small and medium enterprises have a president above retirement age, and 52% of these companies do not have an identified successor. Selling out to competitors or PE funds – many of whom still have substantial dry powder – can sometimes be the only route to survival.

Governance is another catalyst. Tokyo still has 219 listed subsidiaries with a listed parent. In the face of a multi-pronged assault on these structures by regulators, stock exchanges and shareholders, it is not surprising that parent / subsidiary clean-ups are behind many deals. Participating institutions also gain the reputational benefits of “enhancing ESG”.

Furthermore, Japanese equities look cheap globally at 1x book and with the yen at 130.

Minority shareholders must be extra-vigilant. The flood of deals inevitably causes some acquirers to bet that even manifestly unfair transactions will get waved through without proper scrutiny.

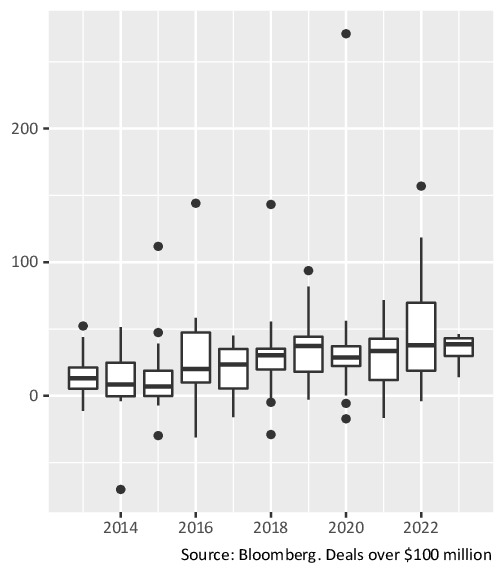

For example, although Japanese takeover premiums are generally high compared to elsewhere and indeed have been trending upwards over the years (figure 2), we have already seen one PE-led deal this year with a sub- 10% premium.

Figure 2: Distribution of takeover premiums in Japan by year (%)

In other recently-announced transactions, parent companies are forcing through deals for listed subsidiaries at unattractive prices and with a lack of procedural protection for minority investors.

Shareholders in Japanese takeover targets must raise their voices when terms are disadvantageous (Metrica will continue to do so in private and in public) and be prepared to follow through with appraisal actions through the courts. This will ultimately lead to better outcomes for investors and corporates alike.