Value-up index announced

Korea Exchange released the details of its long-awaited Korea Value-up index.

As expected, not one non-financial holding company was included in the index, although many listed subsidiaries were. This was not a surprise to us, as we have not seen wholehearted participation in Corporate Value-up (CVU) by any of the nonfinancial holding companies with the exception of LG Corp. We expect this to change over time following pressure by investors, regulators and the stock exchange.

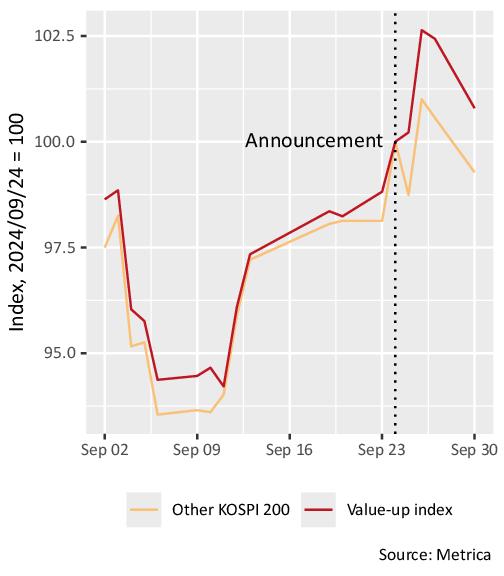

The index constituent announcement had a mild impact on the related stocks. Prior to the announcement, the performance of constituents and non-constituents was similar (figure 1). Subsequently, constituents then outperformed the others by around 2%.

Figure 1: Korea Value-up index constituent performance before and after the announcement, compared with non-constituent KOSPI 200 index members, equally-weighted

Meanwhile the valuations of listed non-financial holding companies are still pricing in very low expectations for CVU.

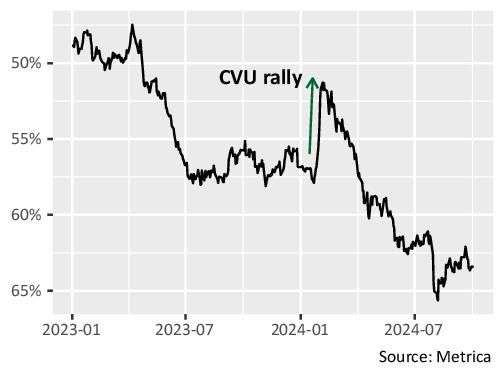

Figure 2 shows the discount to listed NAV (ignoring unlisted assets) of the most liquid Korean holding companies with at least 200% of market capitalisation made up of stakes in other listed companies. While discounts contracted in early 2024 thanks to the initial CVU announcements, this move was quickly reversed and the group now trades 15pp lower than it did less than two years ago.

We view this as an attractive level to be exposed to corporate governance improvements in Korea (CVU or otherwise), and the fund maintains a larger-than-normal gross exposure to the market.

Figure 2: Discount to listed assets of Korean holding companies, January 2023 to present (Includes companies trading at greater than 50% discount as of end date).

Is this it? part II

Investors in Hong Kong and mainland Chinese stocks have been waiting a long time for the market to stop falling. In April we saw the beginnings of a tentative rebound, spurred by the announcement of shareholder-friendly reforms by the China Securities Regulatory Commission and positive macro / earnings headlines, but hopes were dashed soon after as the rally lost steam.

Now we have another attempt by Hong Kong / mainland China to break out of its multi-year bear market. The catalyst seems to be a monetary stimulus package announced by the People’s Bank of China (PBOC) on 23 September. It includes:

- lowering reserve requirement ratios by 0.5pp and the main policy interest rate by 0.2pp, with further cuts possible by year-end;

- cutting mortgage rates for existing home loans by roughly 0.5pp and reducing the nationwide minimum down payment requirement for second homes from 25 percent to 15 percent, while increasing funding support for converting excess housing inventory into affordable housing; and

- supporting the stock market by allowing institutional investors to borrow liquid assets directly from the central bank to invest in equity markets, while lending to banks supporting companies to buy back their own shares.

This has had a dramatic impact on sentiment in the Hong Kong and mainland Chinese markets, causing the Hang Seng and CSI 300 indices to rally by 15.8% and 25.1% respectively from the announcement to 1 October.

Even after the rally, we still see valuations as low, at least in the Special Administrative Region. Figure 1 shows how the forward price-to-book ratio of the Hong Kong market is still not far above a twenty-year low at 1.0x.

Figure 1: Hong Kong forward price-to-book ratio, last twenty years

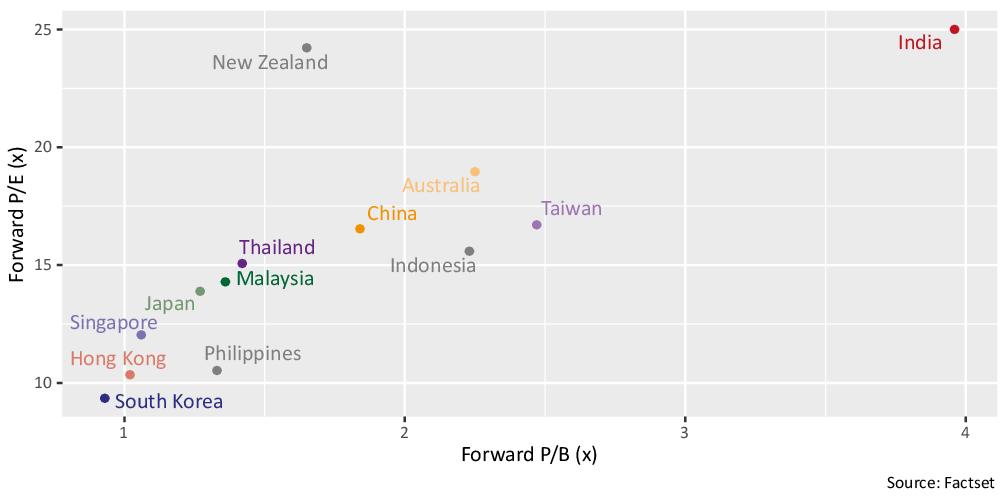

Across the region, Hong Kong is still one of the cheapest markets in terms of price-to-book and price-to-earnings ratios (figure 2) and it is significantly cheaper than mainland China.

Figure 2: Asia-Pacific market price-to-earnings and price-to-book ratios, 1 October 2024

Given the divergence in valuations between Hong Kong and the rest of the region, relative value strategies which take positions in Hong Kong versus other markets should continue to perform well if the rally continues, and the consequent volatility and dispersion should create more shorter-term trading opportunities.

Gentle persuasion

Korea continues to be a key focus. Foreign investors are still generally quite sceptical on the prospects for the Value-up programme, with fewer than 30% expecting it to have a meaningful impact Principal reasons are the perceived inability of the government to pass legislation due to its minority position combined with the structural impediment of an equity market dominated by majority shareholders that seemingly don’t care about share prices.

This scepticism is well-reflected in the prices of potential Value-up beneficiaries such as listed holding companies, which on aggregate are still trading at around start-of-year levels. Very little is priced in, in other words.

Against this backdrop, we continue to maintain our constructive stance. Companies have started to release Value-up plans, targeting higher shareholder value through share buybacks, treasury share cancellations, enhanced dividend policies etc. Although the pace has so far been slow, regulators and others have started to apply gentle persuasion to the laggards. A few days ago, both the Financial Supervisory Service and Financial Services Commission publicly called on companies to speed up their participation in Value-up. The CEO of Korea Exchange (KRX) also met the leaders of the ten largest conglomerates to convey the same message.

In response, LG, Hyundai, POSCO and Kia have committed to publish their Value-up plans in 4Q. We expect that peer pressure will motivate the others to follow in due course – failing which, the pressure from the government, regulators and investors may become a little less gentle.

We acknowledge that the Value-up related tax incentives bill to be submitted to the National Assembly this month will quite likely run into hurdles due to the government’s minority position. However, with the opposition party also aiming to tackle the “Korea discount”, as evidenced by their recent release of a rival plan (the “Korea Booster Project”), we can ultimately expect support from the legislature in one form or another.

In any case, looking at the Japanese example, it has been the efforts of the stock exchange4 rather than the government that have had the greatest impact on market valuations. So even if the legislative effort stalls, we believe Korea can still make further meaningful progress towards a more minority investor-friendly stock market.

In addition, we still have other upcoming catalysts such as the launch of the Value-up index in September and associated exchange-traded fund shortly after.

Round two

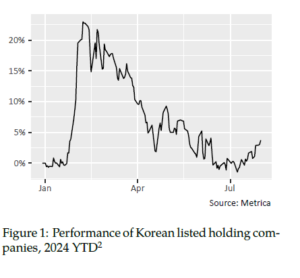

Following a period where the Korean “Corporate Value-Up” (CVU) beneficiaries retreated to below start-of-year levels, effectively pricing in a zero chance of success, the group staged a tentative, partial rebound in July (figure 1), potentially marking the start of “Round two”.

The catalyst may have been the release of CVU plans by two major banks – Shinhan and Woori – incorporating large share buybacks and multiyear shareholder return commitments. It seems that investors are happy to see concrete evidence of progress in the midst of fears over the government’s ability to implement CVU. Shinhan and Woori’s plans were well received by shareholders and highly rated by a leading Korean corporate governance think-tank.

Another encouraging data point was to be found in the 1H 2024 listed company statistics released by the stock exchange. Share buybacks increased 25% year-over-year to KRW2 trillion in the period, and share cancellations were up a staggering 191% to KRW 7 trillion.

Potentially more significant was the release of a new set of proposals – intended to rival CVU – by the opposition Democratic Party of Korea, named “Korea Booster Project”. In contrast to CVU, which incentivizes companies to act through tax incentives, the Korea Booster Project will reformthe Commercial Code to strengthen the rights of minority shareholders through:

- expanding the fiduciary duty of directors to all shareholders (not just the company);

- mandating the appointment of independent directors not influenced by controlling shareholders;

- expanding the separate election of directors who are audit committee members;

- promoting the use of cumulative voting in large corporations (which strengthens the ability of minority shareholders to elect directors); and

- implementing mandatory electronic voting and proxy solicitation for listed companies.

With both ruling and opposition parties now actively seeking to eliminate the “Korea discount”, the prospects for successful reform are significantly higher than what is priced in by the market, in Metrica’s view.

Upcoming catalysts including the “Value-up index” launch in September and creation of the associated exchange-traded fund in Q4 are likely to stimulate further interest in the theme.

India annual price discovery and Korea update

Following a draft proposal released in April, India’s market regulator SEBI recently finalised a market reform aimed at enhancing price discovery and liquidity for the nearly 70 holding companies listed on the country’s stock exchanges.

Under the new regime, the exchanges will hold annual “special call auctions” for the stocks of companies that hold at least 50% of their assets in the form of shares in other listed companies. The main feature of the special call auctions is that they will not have price limits, in contrast to regular trades on the exchanges. They should therefore have the greatest impact on names that are stuck at very low prices due to a lack of trading volume.

The announcement resulted in improved market sentiment towards the whole sector.