A resurgence of catalysts

The Ukraine conflict could have interesting implications for relative value (RV) strategies.

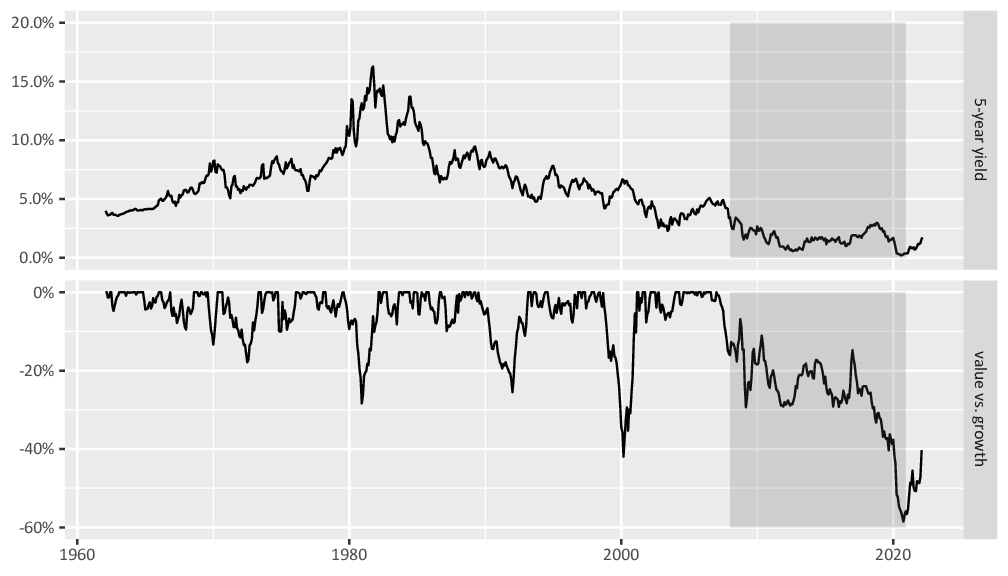

Historically, the worst period for RV strategy performance has been the low-yield, low-growth environment of the years between 2008 and 2020 (the shaded region in the figure below). By contrast, prior to 2008, when yields were higher, RV did well in both high-growth (1960s and 1980s) and low-growth (1970s) eras. It suggests that RV performance is more sensitive to yields than economic growth.

Even prior to the outbreak of the Ukraine conflict, inflation and growth data had started to point to an end to the low-yield regime. This had caused RV trades to gradually recover since November 2020. Wars are generally inflationary (Edward Yardeni, Fed Watching for Fun & Profit). This has been evidenced in recent weeks by soaring prices for soft commodities, energy and metals. All else being equal, inflation should eventually lead to higher yields.

The opposing view is that heightened economic uncertainty will slow down the pace of Fed rate hikes and balance sheet normalisation, keeping a cap on yields.

Metrica’s view is that the inflationary factor will prove to be more significant, meaning that a return to the post-2008 macroeconomic environment is unlikely. So whether or not global growth is affected by the war, the medium-term outlook for RV strategies is positive.