Catalysts emerge

This month we check on the progress of our turning-point thesis.

Record Q1 for M&A

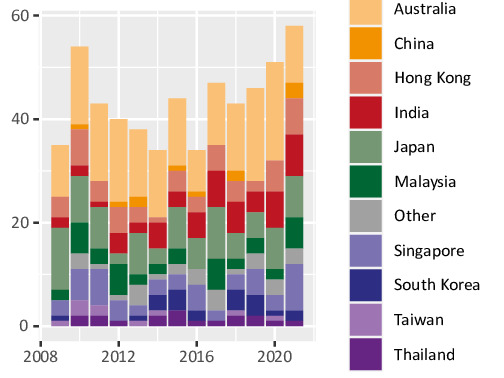

M&A activity in Asia-Pacific is trending at a post-GFC record:

Several drivers exist in our view: (more…)

Implications of bear steepening

Interest rates are in focus, with long-term Treasury yields rising steadily, the curve steepening and implied volatility moving higher.

We have previously considered the effect of these trends on equity relative value performance. How about the impact on corporate merger activity? (more…)

Holding the floor

We have recently written about the potential turning point for Value versus Growth which occurred in mid-November.

To recap, we identified a sharp spike in the volatility of the Value / Growth ratio as resembling a similar event in the year 2000, which at that time marked the start of a long period of Value out-performance.

What do we need for the turning point thesis to hold? (more…)

Why are volatility spikes significant?

In our last post we highlighted a volatility spike in the Value / Growth ratio as a potential sign that the multi-year under-performance of Value might be coming to an end.

More specifically, we looked at the 10-day volatility of the MSCI Asia-Pacific ex-Japan Value index divided by MSCI Asia-Pacific ex-Japan Growth index, which in November spiked to 30 for the first time in twenty years.

The last time this happened marked the start of a long period of Value outperformance.

Volatility spikes are often associated with market turning points. Why? (more…)