It’s not too late

In November we identified a possible turning point in the under-performance of value, based on a sharp spike in the volatility of the Asia-Pacific Value/ Growth ratio, which resembled a similar event in the year 2000. The previous occasion marked the start of a long period of value out-performance.

This is important because a repeat outcome this time should be very positive for RV strategies, which naturally have a long value factor bias.

The key driver back in November was the emergence of data pointing to higher inflation. Inflation is typically negative for growth relative to value, as growth stocks are long-duration assets which are naturally more exposed to long-term rates.

Since November, the performance of Metrica’s relative value strategies has been consistently positive, suggesting that the turning point thesis is valid.

So now that we are in August, a frequent question from investors is: is it too late to take advantage of this trend?

We don’t think so for the following reasons:

A tailwind from dispersion

The main success factor for a relative value strategy is the absolute level of spreads, and as discussed extensively in recent newsletters, the narrowing of value spreads which started in November 2020 is still intact and contributing positively to performance.

A secondary success factor is a high level of dispersion, or the degree to which individual names within the spread universe are moving independently. This is because dispersion helps to mitigate the impact of the inevitable periods of overall spread widening which occur from time to time. It allows rotation out of names which are narrowing against the trend, and into other names which are widening. (more…)

The outlier rejoins the pack

We have been writing for some time about the bottoming-out of the value factor which started in November 2020.

This trend has been observed globally and among the various markets of the Asia-Pacific region.

However, one market had been notably absent from the trend: (more…)

Catalysts emerge

This month we check on the progress of our turning-point thesis.

Record Q1 for M&A

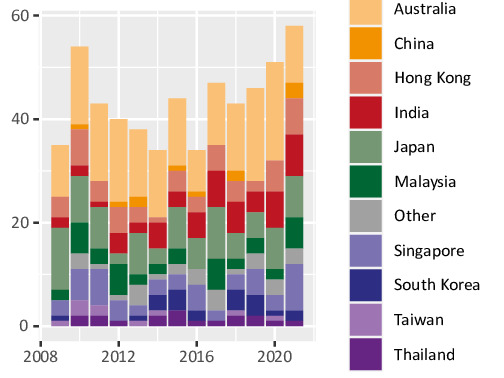

M&A activity in Asia-Pacific is trending at a post-GFC record:

Several drivers exist in our view: (more…)