One in a thousand

Unsolicited and / or hostile tender offers are rare in Asia-Pacific and particularly so in Korea – it ties with China in having the lowest proportion of such transactions (around one in a thousand according to Bloomberg); Australia by contrast has the highest with 12.8% (figure below). (more…)

Vigilance is required

The start of the year has already brought five $100 million-plus Japanese takeovers, representing a decade-plus high for the month of January. It contrasts with a 36% year-on-year slowdown in global M&A. What is behind the uptick? (more…)

Metrica Partners will not tender its funds’ shares in SK Chemicals to SK Discovery

- SK Discovery’s tender offer price is very low, representing a 74% discount to net assets.

- SK Chemicals has still not adequately compensated its shareholders for the split-off of SK Bioscience. The Korean regulator has recognised how split-offs can hurt the interests of investors.

- Only a wholesale restructuring can restore the market’s trust in SK Chemicals.

Please refer to the dedicated website for more information.

Pockets of value

We have been writing about the recovery in the performance of the Value factor since November 2020, and have since highlighted a few corners of the market which fall squarely within the Value category but which have been slow to join the trend.

Another example is the Japanese regional bank sector, which has only just started to move off its lows.

As is well known, Japanese regional banks trade at steep discounts to NAV due to 1) balance sheet volatility caused by their large portfolios of listed securities holdings, built up over the years to strengthen relationships with corporate customers, and 2) poor profitability in their core lending businesses, caused by zero / negative interest rates and sluggish loan demand.

Currently the sector trades at 0.35x book, which is only slightly up from the all-time lows of around 0.30x recorded in 2020 and 2021 (figure below). Regional banks have lagged major banks since 2020 (same chart). (more…)

Engagement and activism may rebound

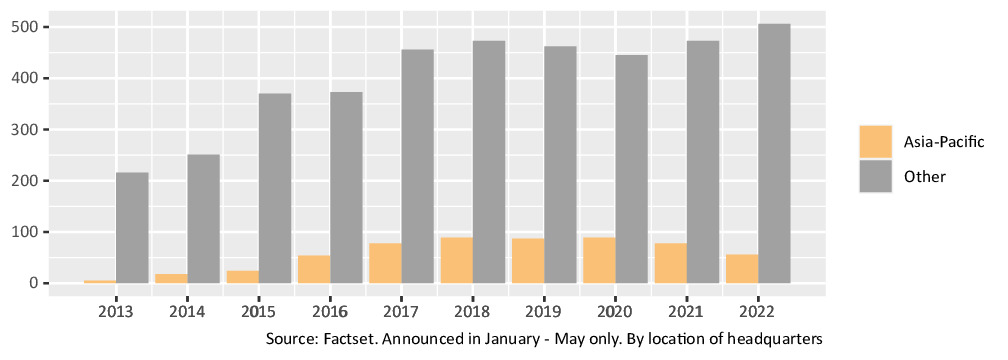

We looked at the Factset SharkWatch database, which tracks global activism campaigns for the last ten years. The dataset initially covered only US campaigns but in recent years has improved its non-US coverage to the extent that we believe it now provides meaningful statistics for Asia-Pacific.

The primary observation is that, while global activism has already started to rebound from the depths of the pandemic – rising 5.2% since 2020 – this growth has all been driven by campaigns outside Asia-Pacific. Figure 1 shows how Asia-Pacific activism (which accounts for around 17% of the total) is still down by 37% compared to 2020, even as the rest of the world has risen 13.7% (note that we considered only campaigns announced in January to May of each year, to make the results comparable across years).

Figure 1: Activist campaigns by region

Why the divergence? We believe it is simply explained by the fact that the three countries which account for 91.1% of the “rest of the world” dataset – namely the USA, Canada and the UK – have all been rolling back Covid restrictions faster than most countries in Asia-Pacific. This has made activism easier to execute and more effective in these markets.

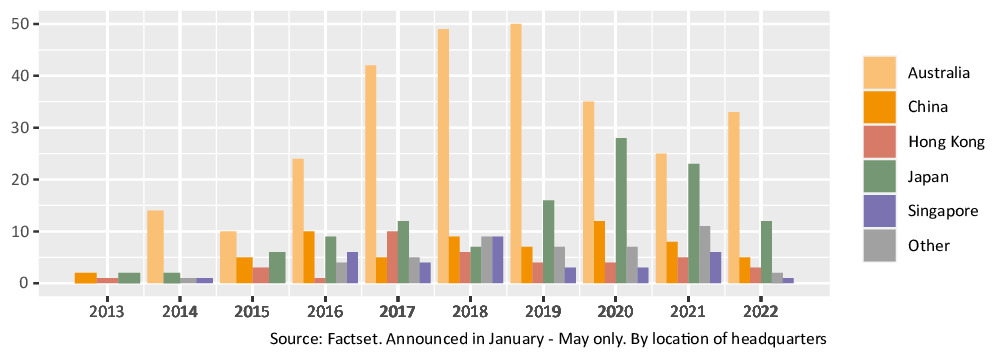

Figure 2: Asia-Pacific activist campaigns by region

Within Asia-Pacific, we see a similar trend. Activism targeting Australia-headquartered companies, which typically accounts for around half the regional total, has been rebounding in 2022 (figure 2), in line with Australia’s re-opening of its economy. Conversely, countries such as Japan and China which persist with closed border policies are still seeing activism falling year-on-year. (more…)