Pockets of value

We have been writing about the recovery in the performance of the Value factor since November 2020, and have since highlighted a few corners of the market which fall squarely within the Value category but which have been slow to join the trend.

Another example is the Japanese regional bank sector, which has only just started to move off its lows.

As is well known, Japanese regional banks trade at steep discounts to NAV due to 1) balance sheet volatility caused by their large portfolios of listed securities holdings, built up over the years to strengthen relationships with corporate customers, and 2) poor profitability in their core lending businesses, caused by zero / negative interest rates and sluggish loan demand.

Currently the sector trades at 0.35x book, which is only slightly up from the all-time lows of around 0.30x recorded in 2020 and 2021 (figure below). Regional banks have lagged major banks since 2020 (same chart). (more…)

Engagement and activism may rebound

We looked at the Factset SharkWatch database, which tracks global activism campaigns for the last ten years. The dataset initially covered only US campaigns but in recent years has improved its non-US coverage to the extent that we believe it now provides meaningful statistics for Asia-Pacific.

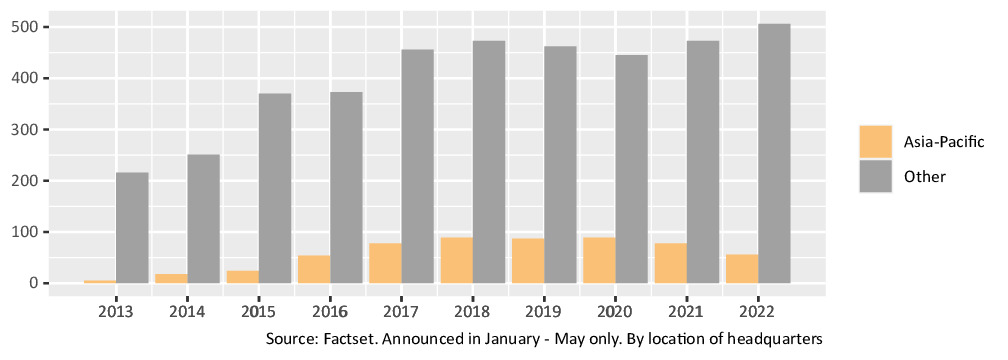

The primary observation is that, while global activism has already started to rebound from the depths of the pandemic – rising 5.2% since 2020 – this growth has all been driven by campaigns outside Asia-Pacific. Figure 1 shows how Asia-Pacific activism (which accounts for around 17% of the total) is still down by 37% compared to 2020, even as the rest of the world has risen 13.7% (note that we considered only campaigns announced in January to May of each year, to make the results comparable across years).

Figure 1: Activist campaigns by region

Why the divergence? We believe it is simply explained by the fact that the three countries which account for 91.1% of the “rest of the world” dataset – namely the USA, Canada and the UK – have all been rolling back Covid restrictions faster than most countries in Asia-Pacific. This has made activism easier to execute and more effective in these markets.

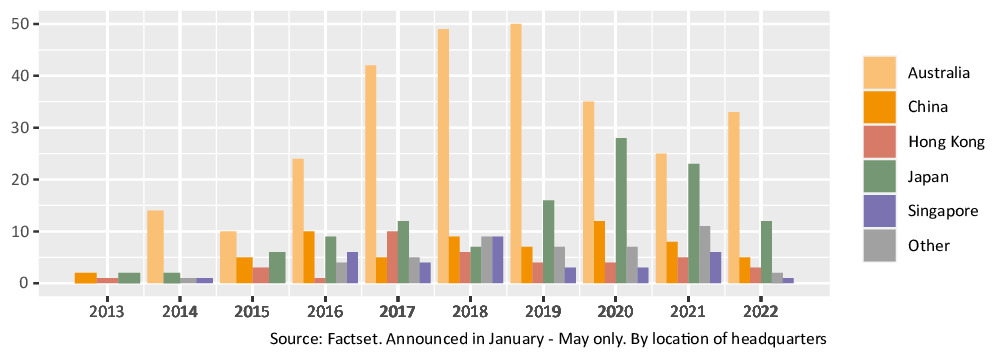

Figure 2: Asia-Pacific activist campaigns by region

Within Asia-Pacific, we see a similar trend. Activism targeting Australia-headquartered companies, which typically accounts for around half the regional total, has been rebounding in 2022 (figure 2), in line with Australia’s re-opening of its economy. Conversely, countries such as Japan and China which persist with closed border policies are still seeing activism falling year-on-year. (more…)

A resurgence of catalysts

The Ukraine conflict could have interesting implications for relative value (RV) strategies.

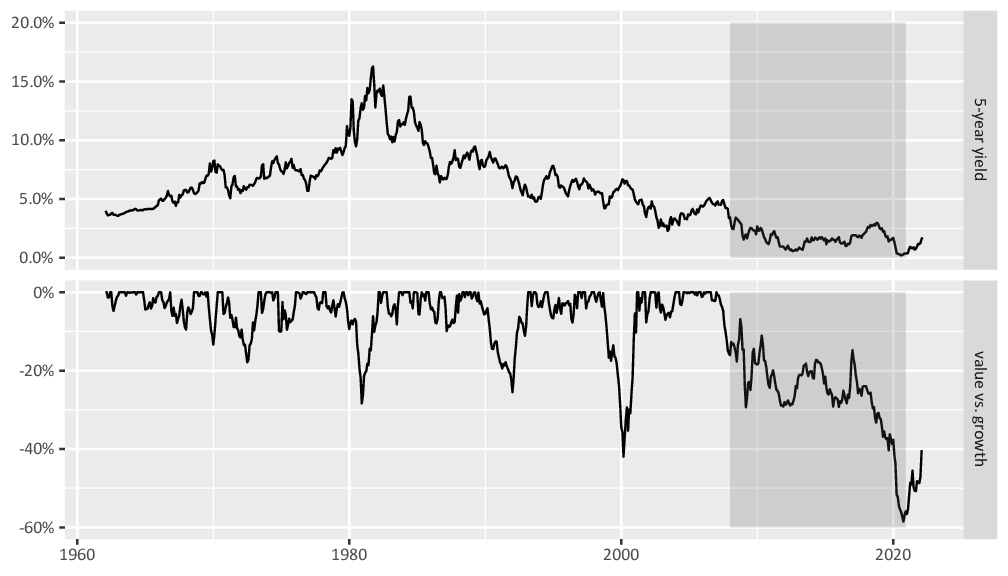

Historically, the worst period for RV strategy performance has been the low-yield, low-growth environment of the years between 2008 and 2020 (the shaded region in the figure below). By contrast, prior to 2008, when yields were higher, RV did well in both high-growth (1960s and 1980s) and low-growth (1970s) eras. It suggests that RV performance is more sensitive to yields than economic growth.

Even prior to the outbreak of the Ukraine conflict, inflation and growth data had started to point to an end to the low-yield regime. This had caused RV trades to gradually recover since November 2020. Wars are generally inflationary (Edward Yardeni, Fed Watching for Fun & Profit). This has been evidenced in recent weeks by soaring prices for soft commodities, energy and metals. All else being equal, inflation should eventually lead to higher yields.

The opposing view is that heightened economic uncertainty will slow down the pace of Fed rate hikes and balance sheet normalisation, keeping a cap on yields.

Metrica’s view is that the inflationary factor will prove to be more significant, meaning that a return to the post-2008 macroeconomic environment is unlikely. So whether or not global growth is affected by the war, the medium-term outlook for RV strategies is positive.

Metrica calls for a strategic review at SK Chemicals

- Metrica welcomes the recent value-improving initiatives announced by SK Chemicals.

- However, these measures have had only a very limited impact on the share price discount, which still exceeds 80%.

- Metrica calls for SK Chemicals to launch a formal strategic review within the next two months to consider further measures to address the discount, up to and including a sale or spin-off of SK Bioscience.

Please refer to the dedicated website for more information.