Round trip, complete

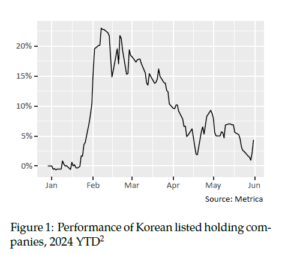

It is rare to see a prominent investment theme go from zero to one hundred and back to zero again in the space of a few months. However, that is the story of Korea’s “Corporate Value Up” (CVU) initiative in 2024. In March, we wrote about how CVU beneficiaries had given back some of their year-to-date performance due to concerns about the government’s ability to enact related legislation post-election. Last month this went even further. Looking at one group of names potentially affected by CVU – listed holding companies – shows how 96% of the initial rally had been reversed by the final week of May (figure 1).

In other words, the market went from pricing in zero chance of CVU prior to President Yoon’s speech in mid-January, to pricing in some meaningful probability (we estimate 20 – 30% based on where holding companies trade elsewhere in the region), and then back to almost-zero again. It is as if investors are getting a second chance to buy Nvidia at the May 2023 price, i.e. prior to the AI theme taking hold. Our views as expressed in the March newsletter are unchanged. While recognising that the path to success is unlikely to be a straight line, we believe that government, stock exchange and investor support for CVU and broader corporate governance reforms is not going away. Catalysts later in the year, such as index and ETF creation, and the promotion of companies adhering to CVU, will create further volatility and opportunities in the Korea market.

A large retracement

Investors are less optimistic about the Korea Corporate Value-up program: (more…)

Corporate Value-up

The Financial Services Commission (FSC) in Korea recently released the “Corporate Value-up Program”. Some highlights: (more…)

Where we stand

We present an update of the value vs. growth draw-down chart featured in past newsletters. (more…)

Naming and shaming

November brought seven management buyout (MBO) announcements in Japan – the most in twelve years (figure 1). We last wrote about Japanese tender offers (including MBOs) in our January newsletter (Vigilance is Required, 3 February 2023). At the time, we identified two medium-term catalysts behind the trend: