Corporate Value-up

The Financial Services Commission (FSC) in Korea recently released the “Corporate Value-up Program”. Some highlights: (more…)

The Financial Services Commission (FSC) in Korea recently released the “Corporate Value-up Program”. Some highlights: (more…)

We present an update of the value vs. growth draw-down chart featured in past newsletters. (more…)

November brought seven management buyout (MBO) announcements in Japan – the most in twelve years (figure 1). We last wrote about Japanese tender offers (including MBOs) in our January newsletter (Vigilance is Required, 3 February 2023). At the time, we identified two medium-term catalysts behind the trend:

SEBI announced a consultation to improve the stock delisting framework.

SEBI’s main proposal would allow any company to be delisted via a fixed price tender offer, contingent upon 90% acceptance by all shareholders. This would be a great improvement on the current system of reverse book-building, which allows shareholders with small stakes to hold a transaction hostage by driving up the tender price to unreasonable levels, frequently resulting in the offeror walking away.

Of particular interest to us was an additional proposal specifically aimed at holding companies – defined by SEBI as those with at least 75% of assets in the form of stakes in other companies.

Assuming two-thirds approval from public (nonpromoter) shareholders, holding companies would be able to delist through a scheme of arrangement whereby the holding company’s shares are cancelled in exchange for shares in the underlying listed holdings, with unlisted shares sold for cash which is then paid out.

The relatively low voting threshold would make it significantly easier to unlock the value contained in some of the deeply-discounted Indian holding companies, in our view.

Japan’s Financial Services Agency is examining a long-standing loophole in the tender offer rules. Currently, an acquirer can buy any amount of shares in a company on-market without having to tender for the whole company.

A tender offer is only required when a 33% or more stake is bought off-market. This contrasts with jurisdictions such as the UK, where an acquirer must make a full tender offer upon reaching a certain threshold, irrespective of how the shares were acquired.

The loophole has resulted in quite a few recent instances of investors coercing companies into paying large dividends or executing large share buybacks, which in many cases have disadvantaged other (particularly foreign) shareholders due to withholding taxes.

Closing the loophole will improve the transparency of the market and level the playing field for all investors.

The regulator is also looking at rules around coordinated actions by multiple shareholders. At the moment, it is not clear how much discussion can take place between shareholders before joint disclosure filings are required. In practice this leads many investors in Japanese listed companies to be cautious about talking to other shareholders.

Dialogue between minority shareholders can be a powerful check on corporate governance. Metrica looks forward to seeing how the new framework facilitates this.

Unsolicited and / or hostile tender offers are rare in Asia-Pacific and particularly so in Korea – it ties with China in having the lowest proportion of such transactions (around one in a thousand according to Bloomberg); Australia by contrast has the highest with 12.8% (figure below). (more…)

The start of the year has already brought five $100 million-plus Japanese takeovers, representing a decade-plus high for the month of January. It contrasts with a 36% year-on-year slowdown in global M&A. What is behind the uptick? (more…)

Please refer to the dedicated website for more information.

We have been writing about the recovery in the performance of the Value factor since November 2020, and have since highlighted a few corners of the market which fall squarely within the Value category but which have been slow to join the trend.

Another example is the Japanese regional bank sector, which has only just started to move off its lows.

As is well known, Japanese regional banks trade at steep discounts to NAV due to 1) balance sheet volatility caused by their large portfolios of listed securities holdings, built up over the years to strengthen relationships with corporate customers, and 2) poor profitability in their core lending businesses, caused by zero / negative interest rates and sluggish loan demand.

Currently the sector trades at 0.35x book, which is only slightly up from the all-time lows of around 0.30x recorded in 2020 and 2021 (figure below). Regional banks have lagged major banks since 2020 (same chart). (more…)

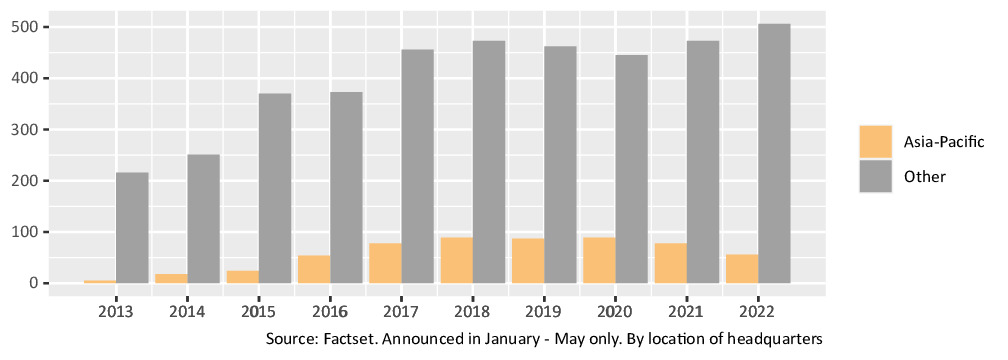

We looked at the Factset SharkWatch database, which tracks global activism campaigns for the last ten years. The dataset initially covered only US campaigns but in recent years has improved its non-US coverage to the extent that we believe it now provides meaningful statistics for Asia-Pacific.

The primary observation is that, while global activism has already started to rebound from the depths of the pandemic – rising 5.2% since 2020 – this growth has all been driven by campaigns outside Asia-Pacific. Figure 1 shows how Asia-Pacific activism (which accounts for around 17% of the total) is still down by 37% compared to 2020, even as the rest of the world has risen 13.7% (note that we considered only campaigns announced in January to May of each year, to make the results comparable across years).

Figure 1: Activist campaigns by region

Why the divergence? We believe it is simply explained by the fact that the three countries which account for 91.1% of the “rest of the world” dataset – namely the USA, Canada and the UK – have all been rolling back Covid restrictions faster than most countries in Asia-Pacific. This has made activism easier to execute and more effective in these markets.

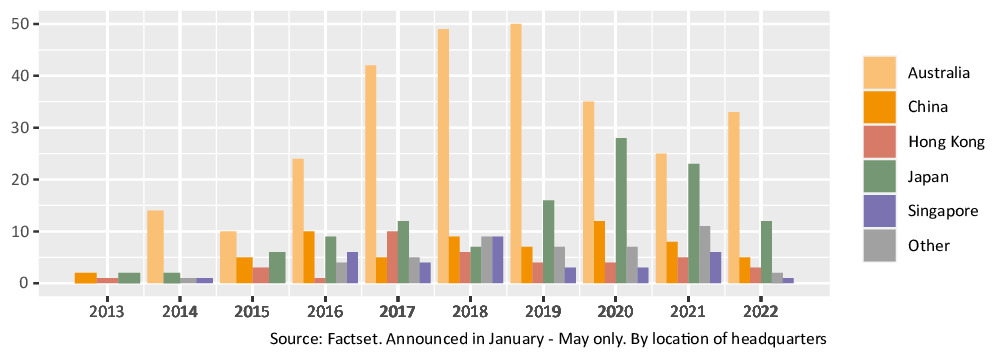

Figure 2: Asia-Pacific activist campaigns by region

Within Asia-Pacific, we see a similar trend. Activism targeting Australia-headquartered companies, which typically accounts for around half the regional total, has been rebounding in 2022 (figure 2), in line with Australia’s re-opening of its economy. Conversely, countries such as Japan and China which persist with closed border policies are still seeing activism falling year-on-year. (more…)