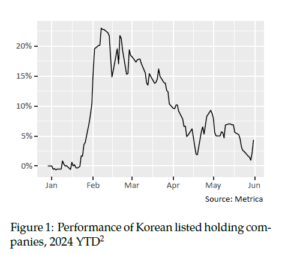

It is rare to see a prominent investment theme go from zero to one hundred and back to zero again in the space of a few months. However, that is the story of Korea’s “Corporate Value Up” (CVU) initiative in 2024. In March, we wrote about how CVU beneficiaries had given back some of their year-to-date performance due to concerns about the government’s ability to enact related legislation post-election. Last month this went even further. Looking at one group of names potentially affected by CVU – listed holding companies – shows how 96% of the initial rally had been reversed by the final week of May (figure 1).

In other words, the market went from pricing in zero chance of CVU prior to President Yoon’s speech in mid-January, to pricing in some meaningful probability (we estimate 20 – 30% based on where holding companies trade elsewhere in the region), and then back to almost-zero again. It is as if investors are getting a second chance to buy Nvidia at the May 2023 price, i.e. prior to the AI theme taking hold. Our views as expressed in the March newsletter are unchanged. While recognising that the path to success is unlikely to be a straight line, we believe that government, stock exchange and investor support for CVU and broader corporate governance reforms is not going away. Catalysts later in the year, such as index and ETF creation, and the promotion of companies adhering to CVU, will create further volatility and opportunities in the Korea market.