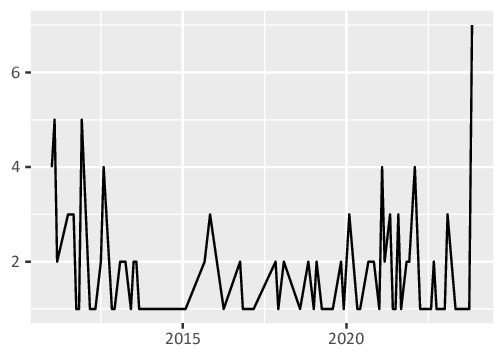

November brought seven management buyout (MBO) announcements in Japan – the most in twelve years (figure 1). We last wrote about Japanese tender offers (including MBOs) in our January newsletter (Vigilance is Required, 3 February 2023). At the time, we identified two medium-term catalysts behind the trend:

Figure 1: MBO announcements per month, Japan, 2011 to date

- Corporate governance: increasing pressure from investors, regulators and stock exchanges to improve shareholder returns and share price valuations has spurred an increase in transactions to facilitate restructuring. For example, Denso (an auto parts manufacturer) just announced a tender to help its parent Toyota Industries reduce cross-shareholdings.

- Succession: many companies – particularly small and medium enterprises – have a president above retirement age, and many of these do not have an identified successor. A sale to competitors or private equity via a tender offer is an increasingly popular strategy for survival.

We also highlighted a near-term catalyst: Japan is the last remaining developed economy with interest rates still close to zero, and this seems unlikely to last indefinitely based on recent Bank of Japan commentary. Bankers are therefore rushing to push through deals – including tender offers – before the window of cheap financing closes. So why the sudden rush of MBOs in particular?

A few weeks ago, Japan Exchange Group, the operator of the Tokyo Stock Exchange (TSE), announced plans to publish a monthly list of companies complying with the exchange’s corporate value enhancement guidelines. This would in effect “name and shame” companies not on the list (69% of the total, as of October).

Naturally, certain listed companies will be reluctant to implement the guidelines, and for those, delisting via an MBO is the obvious route to avoiding public humiliation.

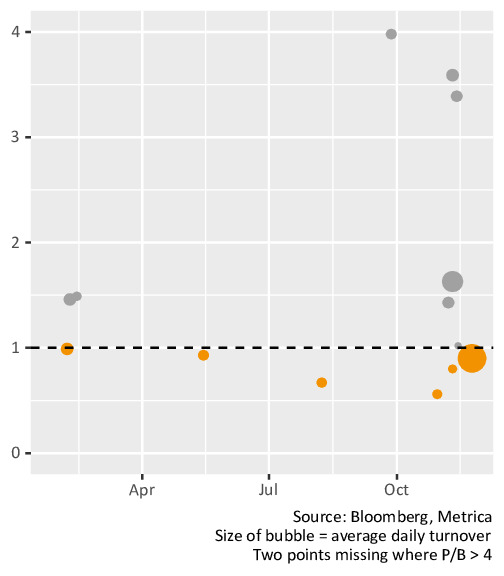

Sometimes, this happens at unfair prices. So far in 2023, six MBOs have been announced for less than book value (figure 2), including one of the largest Japanese MBOs in history.

Figure 2: Acquisition price-to-book multiple of Japanese MBOs, 2023

In other words, although the TSE specifically focused on companies trading below book when announcing the guidelines, some are choosing to delist at suboptimal valuations rather than take the guidelines seriously to create meaningful value for public shareholders.

Metrica believes that some of these situations will lead to heated battles between investors and acquirers, and we are positioning the portfolio and planning engagements accordingly.