This month we check on the progress of our turning-point thesis.

In our November newsletter we wrote: “We may finally have seen a turning point in the underperformance of Value.” That assertion was based on a sharp spike in the volatility of the Asia-Pacific Value / Growth ratio, which resembled a similar event in the year 2000. The previous occasion marked the start of a long period of Value outperformance.

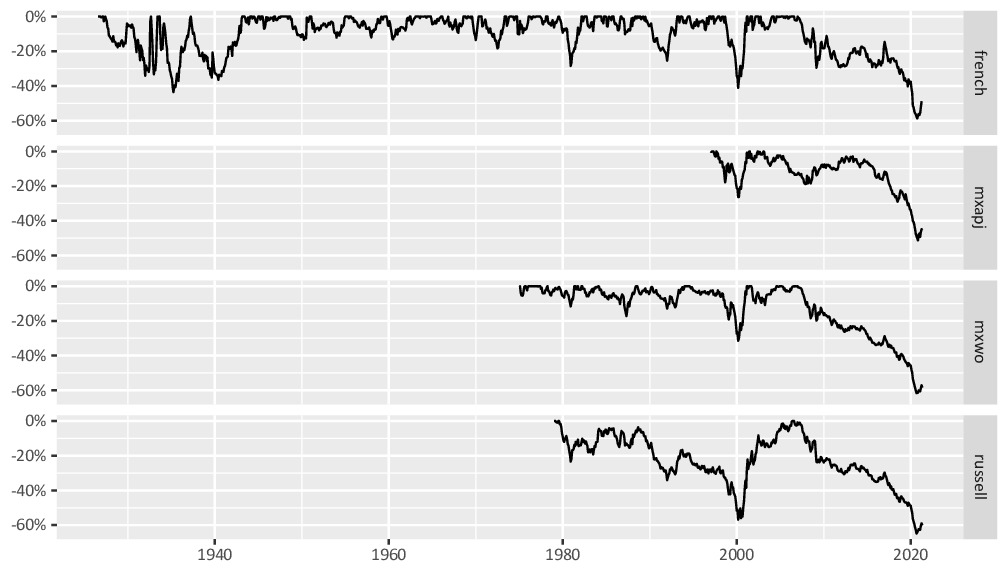

This is important because a repeat outcome this time should be very positive for RV strategies, which naturally have a long Value factor bias. The chart below shows the performance of Value versus Growth going back 94 years. So far, we can say that the turning-point thesis is still intact, with Value continuing to outperform Growth year-to-date for all four benchmarks.

What’s driving this? As before, the answer must be ongoing signs that inflation is rekindling. Iron ore, copper and palladium are at all-time highs. Agricultural commodities are appreciating. The ISM Manufacturing Prices index released two days ago reached a level not seen since July 2008. Google searches for “inflation” are hitting an all-time high. And Berkshire Hathaway this week observed “very substantial inflation” across most of its businesses.

Against this is the Jerome Powell view that any price spikes will prove to be a temporary phenomenon given that inflation has been dormant for 25 years.

We do not take a strong view on which particular view of the world will turn out to be correct, but as shown in the chart, we are still close to the bottom of the largest draw-down in history, and the upside from a reversion to the mean is substantial.

In addition to a potentially supportive macro environment, we may now be starting to see more contribution from the micro side, with the resumption of stock buy-backs, listed asset spin-offs, tender offers, activist campaigns and other catalysts to reduce discounts – all of which were put on hold in 2020. We saw an example of this in April, where a name in one of our portfolios started to buy back its shares at a very cheap valuation.