We look at the current opportunity set in Asia-Pacific M&A, and how it has changed since the onset of the pandemic.

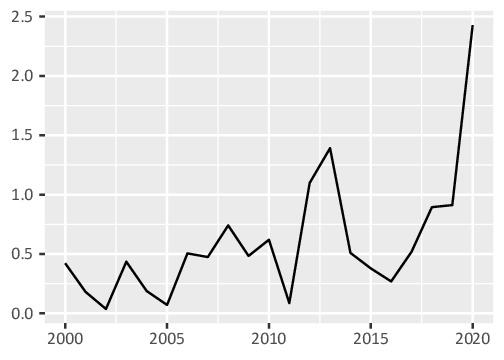

The figure below shows the cancellation / completion ratio of Asia-Pacific deals going back twenty years. The chart shows how this year has been a huge outlier, with the ratio moving well above two times, compared with a historical range rarely exceeding one. In other words, in 2020, more than two deals have been cancelled for every deal that has completed. This indicates the scale of the disruption in the M&A space this year.

M&A cancel / complete ratio (x)

What does this imply for M&A investment returns for the rest of the year? We think they will be strongly positive for the following reasons:

- We believe the cancellation / completion ratio has peaked.The biggest driver of failed deals this year has been bidders seeking to rely on Material Adverse Change (MAC) clauses to walk away from transactions agreed prior to the pandemic.We think this trend should be coming to an end, as the pandemic is now a known quantity and buyers can no longer claim they were unaware of it. Furthermore, sellers will naturally ask for more protection to be built into transaction documentation.Even for existing deals, it is not a given that buyers can walk away without any consequences. As we wrote in our last newsletter, a global pandemic should arguably be exactly the type of scenario covered by MAC exclusions for “changes in general economic conditions”.There is surprisingly little case law on this subject, so we had been looking forward to seeing L Brands and Sycamore fight it out in a Delaware courtroom. Disappointingly, it appears that the parties have just reached a settlement.Closer to home though, we are currently aware of two deals in Australia and New Zealand where target companies have rejected the buyers’ reliance on MAC clauses, and are threatening court action. In one of these cases, shareholders are also involved. There is even less legal precedent in this part of the world but ultimately we think it is unlikely that either case will end up in court. Nevertheless, we believe the willingness of targets to fight back against bidders’ attempts to renege on deals will make future deal failures less frequent. In other words, we see deal completion rates trending higher from here.

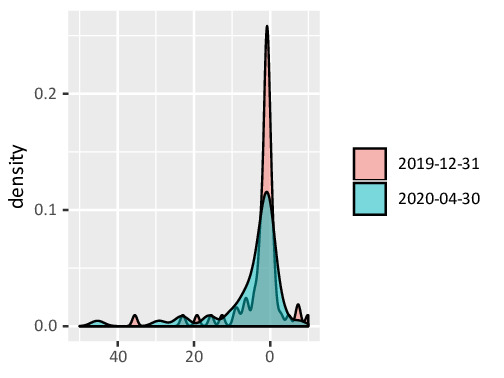

- Upside has measurably increased.The figure below shows a distribution of discounts to announced terms for Asia-Pacific M&A deals at end-December 2019 (prior to the Covid-19 sell-off) and at end-April. Pre-Covid-19, discounts were very tightly clustered around a median of 0.99%. Now the median has shifted to 1.40%, meaning more potential upside for every deal. Also, now that the distribution is wider, there is more scope for adding alpha by trading the spreads between wide and narrow discounts.

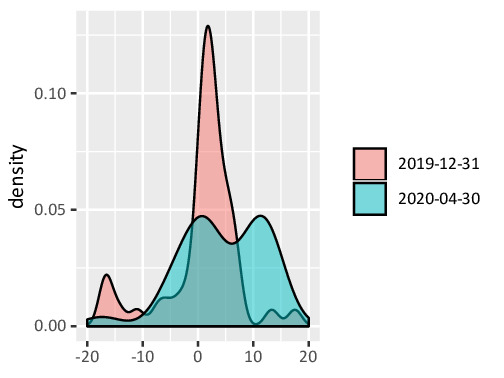

Discounts to announced terms (%) The figure below tells a similar story in terms of annualised returns to deal completion. The median annualised return has increased by almost four times, from 2.7% to 10.5%. And again, the range has increased substantially.

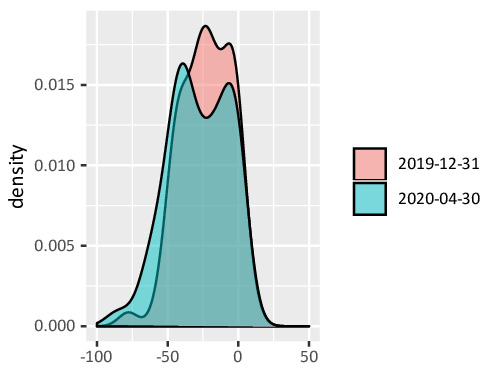

Annualised return to terms (%) - Downside risks haven’t increased much.The next figure shows a distribution of break risk estimates for live deals. This shows how much a target stock would be expected to fall if a deal breaks. It incorporates such factors as the announced deal premium and the progression of the market and comparable companies post-announcement.

Break risks (%) The chart shows that, at the end of last year, most break risks were –60% to 0%, with a few outliers on either side.

Moving to April, there has been a slight shift to the left and a fattening of the lower tail. However, we don’t see this as a particularly significant change in the distribution considering that the the MSCI AC Asia-Pacific index fell 13.3% over the same period.

So a large increase in upside potential has not brought about a similar increase in downside risk. And as we stated earlier, the probability of deals closing should be trending upwards from here on. This suggests a good environment for investing in M&A situations.

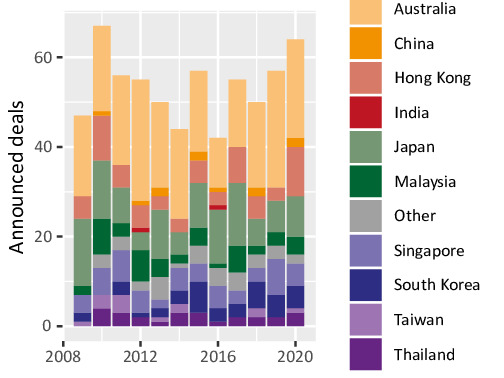

- Deal volumes are still high.Year-to-date announced M&A is still close to the post-GFC record, with over 60 new deals announced so far in 2020 (figure [below]).

Announced deals: January to April We were originally expecting more of a slowdown, as it is hard to conduct due diligence in a lock-down. Nevertheless, for deals which don’t require onsite visits – e.g. company founders / insiders buying back their companies at distressed valuations – the increase has been more than enough to keep the overall activity level relatively healthy. Hong Kong in particular has seen a flurry of related-party take-private proposals in the last few weeks.