A turning point?

We may finally have seen a turning point in the under-performance of Value.

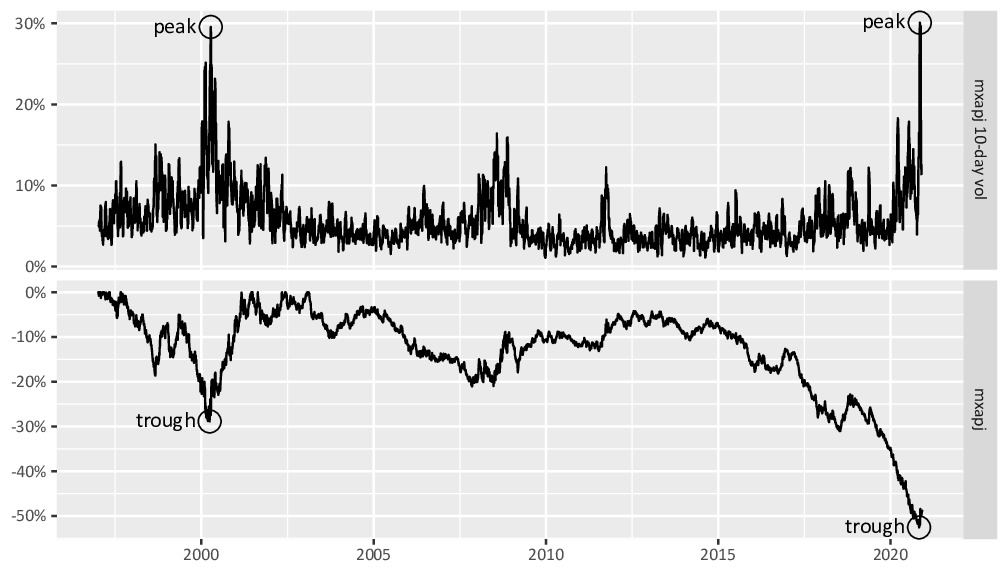

The volatility of the Value / Growth ratio in Asia-Pacific surged to 30% on 6 November. The last time we saw a similar level was just over twenty years ago, on 10 April 2000:

This is significant because (more…)

Worst performance of value since 1926

We continue to have a strong conviction in a strategy of buying companies at 80-90% discount to NAV, with an expectation of a catalyst for value realisation.

While over the long-term this has proven to be a very effective strategy, it has performed poorly over the past year.

What could be the cause? We believe the global underperformance of the value factor is the main culprit.

We have previously illustrated this using benchmarks from MSCI and Russell Investments. However, to show just how extreme the current moves are, (more…)

Congratulations to the new chairman of NBI

Metrica Partners notes the resignation of the chairman of NBI, announced today, and welcomes his successor: https://nbi-shareholders.com/2020/09/22/congratulations-to-the-new-chairman/

Second letter to NBI Industrial Finance

Metrica today sent a second letter to the chairman of NBI: https://nbi-shareholders.com/2020/09/21/second-letter-to-nbi-board/

LINE must postpone the squeeze-out EGM

Mr. LEE Hae-Jin

Chairman of the Board

LINE Corporation

JR Shinjuku Miraina Tower 23F

4-1-6 Shinjuku

Shinjuku-ku

Tokyo 160-0022

Japan

Dear Mr. Lee, (more…)