A pathway to stability

The long-awaited impeachment trial verdict in Korea is due the day after this newsletter goes to press. If the impeachment is upheld, a presidential election must be held within sixty days. A victory for the opposition candidate Lee Jae-myung, who narrowly lost to President Yoon in the last election, would have positive implications for the market, as it would allow the Democratic Party of Korea (DPK) to push through its corporate governance reform agenda unhindered. Conversely, a continuation of the status quo whereby the People Power Party holds the presidency and the DPK controls the National Assembly would be less favourable, as it would prolong the political stalemate. Even so, much progress was made on Yoon’s “Corporate Value-up” initiative in 2024 under essentially the same structure, and we would expect the governance reform momentum to continue in any case. It is worth remembering that Japan was able to achieve significant progress towards the same goals through non-legislative measures.

Korea reform

Korea’s government and main opposition party continue to push their respective stock market and corporate governance reform agendas. The vice-chairman of the Financial Services Commission (FSC) appeared at several conferences in February to highlight the government’s continued commitment to “Value-up”. On one measure – share buybacks – Value-up is already proving to be a success, with Korean companies increasing buybacks by 72.8% year-on-year to $9.8 billion in 2024. However, both the FSC and Korea Exchange want to boost the number of listed firms releasing general Value-up plans beyond the current 114. As such, the government is promoting a bill to reduce corporate taxes for companies practising Value-up and to lower dividend income taxes for investors in such firms.

On the opposition side, the Democratic Party of Korea (DPK) has been pushing through its amendment to the Commercial Act which makes company directors answerable to shareholders as well as companies.

The bill is likely to be presented to the National Assembly in March. Both the government’s and the opposition’s bills face obstacles given Korea’s turmoil, but the important point is that both ends of the political spectrum want to see the stock market higher.

As such, if the presidential impeachment issue is resolved soon (current projection is mid-March) and stability returns, via elections or otherwise, it should be a positive for the reform programme.

In the meantime, another upcoming catalyst for the market is the lifting of the short-sell ban at the end of March.

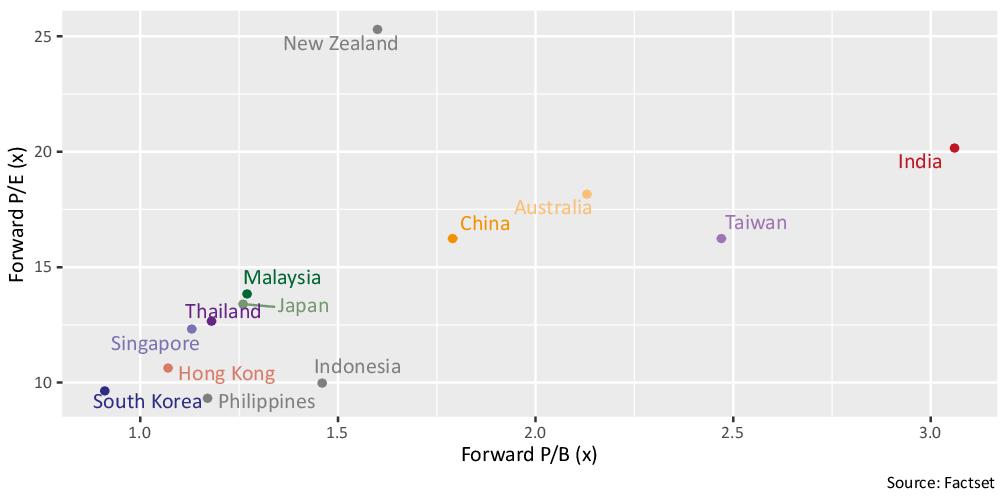

Metrica believes that the 15-month ban has hurt the market’s liquidity and depressed valuations, to the extent that Korea is now the only market in Asia-Pacific trading below book value and one of two below 10x earnings (figure below).

Asia-pacific market price-to-earnings and price-to-book ratios, 28 February 2025

Looking at the relative value universe presents a similar picture, with Korea spreads on average far wider than anything else seen in the region. If the original objective of this ban was to support the stock market, it has been unsuccessful. During the period since the ban was enacted, the Korean market has returned exactly 0.0%. By comparison, markets which freely allow short-selling such as the US, Europe and Japan have returned 36.4%, 31.4% and 13.6% respectively over the same period. MSCI also cited the short-sell ban as a reason not to upgrade Korea to Developed Market status.

There is always a risk that, given the depressed state of the Korean market, the ban will be extended yet again. However, Metrica is cautiously optimistic that the authorities will do the right thing. A resumption of short-selling should draw capital back into the market, and in particular into some of the more extreme spreads that can be found in the RV universe.

Minority shareholder protection

It was good to see the Korea Exchange following though on its commitment to protect minority shareholders in the case of spin-off re-listings. Binggrae, a manufacturer of dairy products, was forced to withdraw its plan to split into a holding company + operating company after the exchange refused to approve the listing of the new company. This is historic as the exchange has previously waved through such restructurings.

In the past, majority owners of Korean companies loved to convert them into holdcos + opcos, as this allowed them to take capital out while maintaining control. It also depressed the prices of holdcos, lowering potential inheritance taxes. Perhaps the Binggrae case is a sign that Korea is finally starting to move on from this abusive and outdated practice which is no longer tolerated by any developed market globally.

Korea stewardship code

In line with our continued commitment to the Asian markets and our dedication to fulfilling our stewardship responsibilities, we have initiated the process of registering Metrica as a participant in the Korea Stewardship Code.

For further details, please refer to the following disclosure link here.

Seeds of doubt

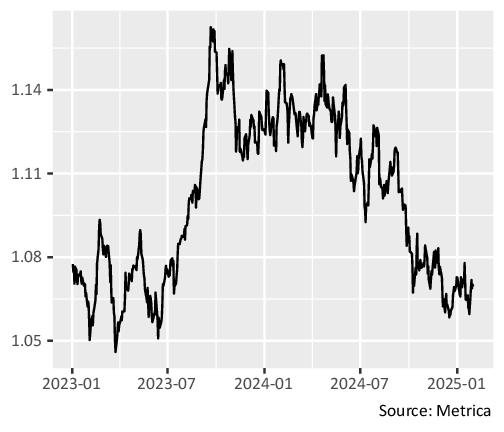

RV spreads have been drifting wider since May 2024, and on one measure — the ratio between MSCI Value and Growth indices — levels are now back to multi-year extremes (figure below).

MSCI Asia-Pacific Value / Growth

Unusually, this has been happening during a time when US short-term and long-term rates are moving higher, a trend which is normally associated with outperformance of short-duration stocks (Value) over long (Growth). It means that either equity investors are ignoring the consequences of higher rates, or they are revising up growth expectations at a pace fast enough to outweigh the impact.

In any case, companies which are valued not on discounted cash flows but on hard assets – such as those in certain RV strategies – are now cheap again. But given that we have retraced back to the low point on the chart, can we expect a brighter period ahead for RV?

We believe that two recent developments have raised the probability in favour of “yes”.

The first is the release of the R1 large language model by Chinese AI firm DeepSeek. The seemingly rock-bottom development cost of this model has called into question the potential returns on the estimated one trillion dollars2 already invested or to be invested into generative AI. The concern is: if good quality models can now be created on the cheap, do we really still need all those Nvidia chips, power transformers and data centres?

The news significantly boosted the volatility of stocks in the space, and we expect this to continue, which should be a positive for RV strategy returns.

The second development is the threatened or actual imposition of tariffs by the US upon its trading partners. While on the face of it this should not be a great surprise given the record of the previous Trump administration, it may have unexpected consequences for inflation this time around. During the last episode, we had been through thirty years of declining prices, leaving companies barely able to pass on tariffs to their customers. This time however, the macroeconomic environment is clearly different. An upside surprise to inflation would result in higher volatility in long-duration stocks which naturally tend to be more sensitive to rate expectations.

This would have an even greater impact on RV performance given that it affects all long-duration securities – not just AI-related.

Looking ahead

Event-driven outlook

We begin 2025 with a survey of current opportunities in Metrica’s core strategies.

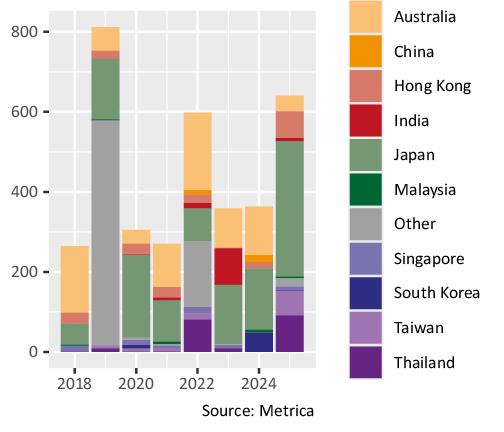

Firstly, in the event-driven (hard catalyst) strategy, one of the key performance drivers is the liquidity of the target universe, as it correlates with the frequency and depth of trading opportunities.

Figure 1 shows, as of the beginning of each year, the average daily turnover of M&A targets listed in Asia-Pacific (the coloured bars) or listed outside Asia-Pacific but where the acquirer is paying in shares listed in Asia-Pacific (the grey bars marked “Other”).

Figure 1: Daily liquidity of Asia-Pacific M&A deals at start of year, 2018 to date

The chart shows how daily liquidity in the Asia- Pacific M&A universe has improved to a post-2019 high of $641 million, and is 77% higher than a year ago.

Japan has driven much of the increase, which is not a surprise given sustained low-interest rates, corporate succession issues and a resurgent investor focus on balance sheet inefficiencies and governance reform. With many deals subject to upside tension from competitive bidders and/or shareholders unhappy with low-balled terms, Japan should continue to provide a key source of opportunities in the event-driven space.

Similarly, Hong Kong continues to see healthy deal activity, although in this case it is largely from major shareholders seeking to privatise companies at historically cheap valuations, with a view to relisting elsewhere. Many transactions are driven by state-owned enterprises (SOE), and in this regard we were pleased to see the recent guidelines for SOEs published by the State-owned Assets Supervision and Administration Commission (SASAC), which explicitly mention share price performance and valuation as criteria for manager evaluation. The guidelines should incentivise more SOEs to tackle the under-valuation of their Hong Kong-listed shares, creating further trading opportunities in this market.

RV outlook

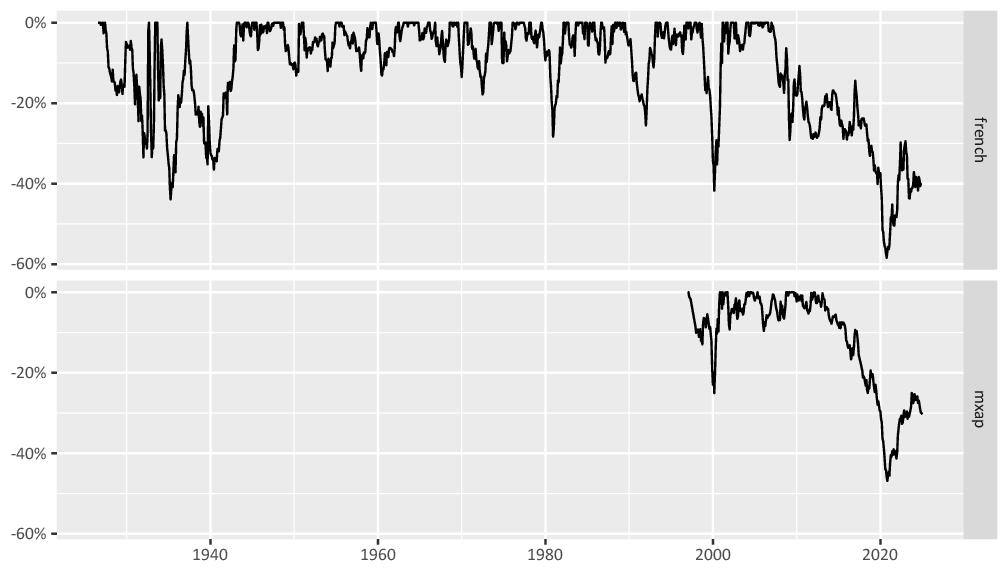

Turning to the relative value strategy, we first update the value vs. growth draw-down chart featured in past newsletters (figure 2). As a reminder, the french series is Professor Kenneth R. French’s dataset of US stocks which goes back almost one hundred years, and the mxap series is based on MSCI Asia-Pacific which has less history but which is more applicable to the fund’s core universe.

Figure 2: Draw-down from peak return for value vs. growth, 1926 to present

The chart shows the extent to which value investing (and by extension, RV investing) is or is not working4. It can be seen that, following a very steep draw-down in 2020, value has retraced around one-third of its way back to the long-term path. Longer-term, there is still around 40%+ upside to reach the 0% level.

The retracement trend paused a little over the past year as momentum factors took over. By some measures, 2024 was a record year for momentum strategies5, with the US stock market in particular posting its largest two-year gain since 1998.

While it is obviously difficult to call the top of any trend, it would be quite unusual by historical standards to see this extend into a third year. As such, the value factor may come back into favour in 2025, with positive implications for relative value strategies.

Nevertheless, given the partial retracement of value performance, does this mean that the best days are already over for RV strategies?

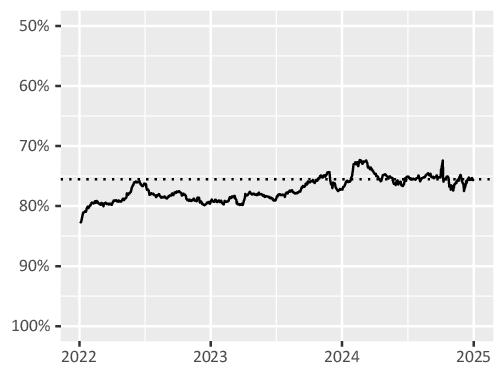

“Not at all” would be our answer. Looking at a weighted average discount to fair value for a representative sample of RV names shows how it ended 2024 at roughly the same level as it reached 30 months ago (on 17 June 2022 – dashed line in figure 3 – note the reversed axis), despite the value factor rebound.

Figure 3: Weighted average discount to fair value of sample RV names (discount compression trades), 2022 to date