In Korea, it was good to see the second set of amendments to the Commercial Act passed on 25 August. Listed companies with assets exceeding two trillion won will now have to adopt cumulative voting, making it dramatically easier for minority shareholders to get at least one candidate onto the board.

The next set of amendments to the Commercial Act, scheduled for later this year, will include the mandatory cancellation of treasury shares.

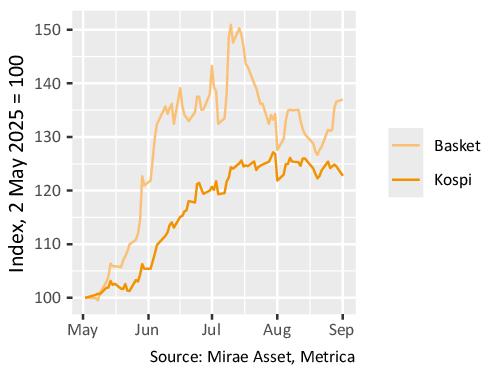

Treasury shares have been a focus topic in the Korean market since Lee Jae Myung initiated his presidential campaign, with a basket of treasury share-heavy holding companies beating the index by around 25% at one point (figure below).

Performance of a basket of holding companies with large treasury share holdings, May 2025 to present

The reason is that, in the past, treasury shares have often been misused to defend management rights against hostile takeovers or shareholder activism. Consequently, the ruling Democratic Party of Korea is proposing that companies must cancel their treasury shares within a certain timeframe, which has not been determined yet but is likely to be immediate to one year for newly-acquired treasury shares, and six months to five years for existing holdings.

Korea’s business community has inevitably voiced strong opposition to these measures, arguing that treasury shares are a strategic tool for defending management control, such that rapidly cancelling decades’ worth of accumulated shares would be not only impractical but would also leave companies exposed to foreign hostile takeovers.

Given the progress made to date on other reform measures, Metrica is reasonably confident that the government will be able to push through the treasury share cancellation bill with timeframes on the shorter end. This will improve transparency in the market and reduce the ability of companies to use treasury shares for illegitimate purposes.

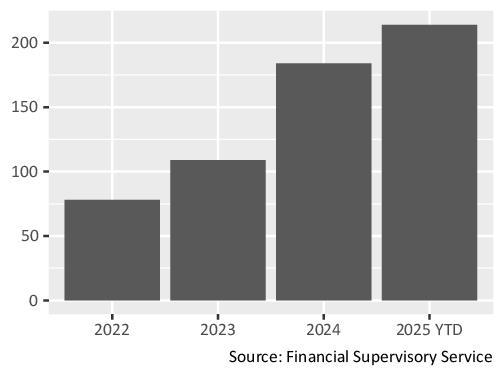

Some companies have already been ramping up cancellations (figure below), spurred by the “Value-up” initiatives of former President Yoon and an increased focus on corporate governance by domestic investors.

Treasury share cancellation announcements by listed firms in South Korea