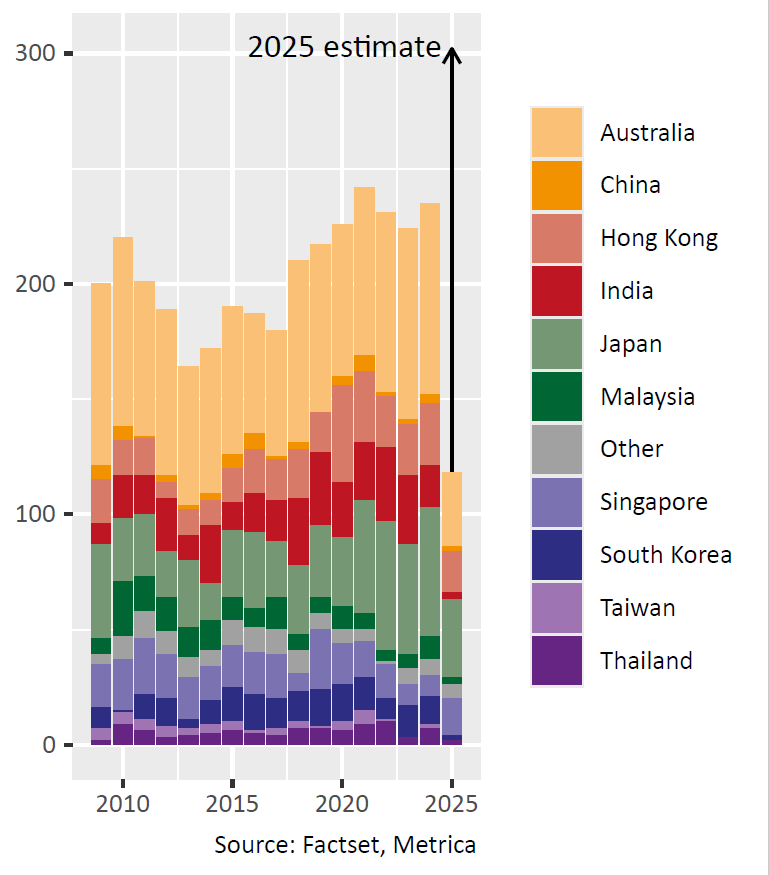

It is proving to be a very busy year for Asia-Pacific M&A, with the number of deals on track to exceed 300, comfortably exceeding the previous peak of 242 (figure below). Hong Kong, Singapore and Japan have shown the greatest leaps in activity, with run rates of 3.5x, 3.0x and 2.1x the post-2009 average, respectively.

Announced M&A deals with target listed in Asia-Pacific, 2009 to present

Japan remains an area of particular interest. This year’s surge in dealmaking seems mostly driven by two Tokyo Stock Exchange initiatives:

- In February the exchange published a presentation containing views sharply critical of listed parent-subsidiary structures8. Since then at least $50 billion of clean-up transactions have been announced, including NTT / NTT Data, Toyota Industries / Toyota Motor, KDDI / Kyocera and Aeon / Aeon Mall. Japan still has more than 200 listed subsidiaries9 so there is plenty more to be done on this front.

- Next month the exchange will significantly tighten protections for minority investors in going-private deals10. A broader range of deals will now be caught by the requirement to obtain a special committee (SC) opinion. The SC will now have to consider whether any increase in corporate value will be fairly distributed to minority shareholders. The new rules also require greater transparency for any valuations performed in the analysis.

Some acquirers are clearly taking advantage of the rush to get deals done at very low prices, and a number of these situations offer interesting optionality, according to Metrica’s analysis.