Korea’s government and main opposition party continue to push their respective stock market and corporate governance reform agendas. The vice-chairman of the Financial Services Commission (FSC) appeared at several conferences in February to highlight the government’s continued commitment to “Value-up”. On one measure – share buybacks – Value-up is already proving to be a success, with Korean companies increasing buybacks by 72.8% year-on-year to $9.8 billion in 2024. However, both the FSC and Korea Exchange want to boost the number of listed firms releasing general Value-up plans beyond the current 114. As such, the government is promoting a bill to reduce corporate taxes for companies practising Value-up and to lower dividend income taxes for investors in such firms.

On the opposition side, the Democratic Party of Korea (DPK) has been pushing through its amendment to the Commercial Act which makes company directors answerable to shareholders as well as companies.

The bill is likely to be presented to the National Assembly in March. Both the government’s and the opposition’s bills face obstacles given Korea’s turmoil, but the important point is that both ends of the political spectrum want to see the stock market higher.

As such, if the presidential impeachment issue is resolved soon (current projection is mid-March) and stability returns, via elections or otherwise, it should be a positive for the reform programme.

In the meantime, another upcoming catalyst for the market is the lifting of the short-sell ban at the end of March.

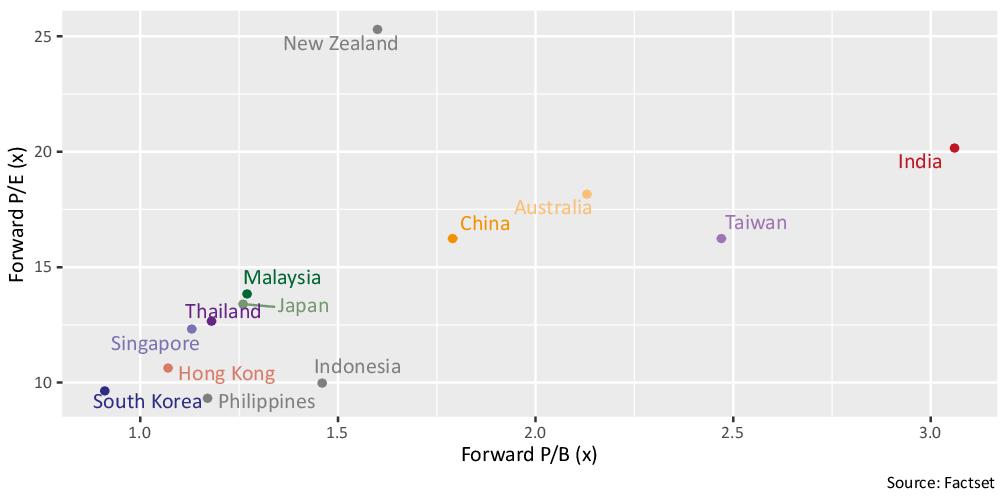

Metrica believes that the 15-month ban has hurt the market’s liquidity and depressed valuations, to the extent that Korea is now the only market in Asia-Pacific trading below book value and one of two below 10x earnings (figure below).

Asia-pacific market price-to-earnings and price-to-book ratios, 28 February 2025

Looking at the relative value universe presents a similar picture, with Korea spreads on average far wider than anything else seen in the region. If the original objective of this ban was to support the stock market, it has been unsuccessful. During the period since the ban was enacted, the Korean market has returned exactly 0.0%. By comparison, markets which freely allow short-selling such as the US, Europe and Japan have returned 36.4%, 31.4% and 13.6% respectively over the same period. MSCI also cited the short-sell ban as a reason not to upgrade Korea to Developed Market status.

There is always a risk that, given the depressed state of the Korean market, the ban will be extended yet again. However, Metrica is cautiously optimistic that the authorities will do the right thing. A resumption of short-selling should draw capital back into the market, and in particular into some of the more extreme spreads that can be found in the RV universe.

Minority shareholder protection

It was good to see the Korea Exchange following though on its commitment to protect minority shareholders in the case of spin-off re-listings. Binggrae, a manufacturer of dairy products, was forced to withdraw its plan to split into a holding company + operating company after the exchange refused to approve the listing of the new company. This is historic as the exchange has previously waved through such restructurings.

In the past, majority owners of Korean companies loved to convert them into holdcos + opcos, as this allowed them to take capital out while maintaining control. It also depressed the prices of holdcos, lowering potential inheritance taxes. Perhaps the Binggrae case is a sign that Korea is finally starting to move on from this abusive and outdated practice which is no longer tolerated by any developed market globally.