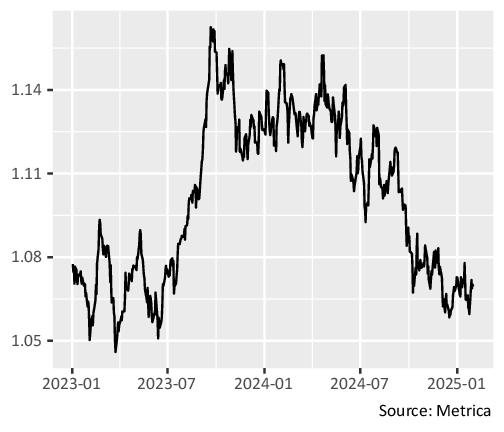

RV spreads have been drifting wider since May 2024, and on one measure — the ratio between MSCI Value and Growth indices — levels are now back to multi-year extremes (figure below).

MSCI Asia-Pacific Value / Growth

Unusually, this has been happening during a time when US short-term and long-term rates are moving higher, a trend which is normally associated with outperformance of short-duration stocks (Value) over long (Growth). It means that either equity investors are ignoring the consequences of higher rates, or they are revising up growth expectations at a pace fast enough to outweigh the impact.

In any case, companies which are valued not on discounted cash flows but on hard assets – such as those in certain RV strategies – are now cheap again. But given that we have retraced back to the low point on the chart, can we expect a brighter period ahead for RV?

We believe that two recent developments have raised the probability in favour of “yes”.

The first is the release of the R1 large language model by Chinese AI firm DeepSeek. The seemingly rock-bottom development cost of this model has called into question the potential returns on the estimated one trillion dollars2 already invested or to be invested into generative AI. The concern is: if good quality models can now be created on the cheap, do we really still need all those Nvidia chips, power transformers and data centres?

The news significantly boosted the volatility of stocks in the space, and we expect this to continue, which should be a positive for RV strategy returns.

The second development is the threatened or actual imposition of tariffs by the US upon its trading partners. While on the face of it this should not be a great surprise given the record of the previous Trump administration, it may have unexpected consequences for inflation this time around. During the last episode, we had been through thirty years of declining prices, leaving companies barely able to pass on tariffs to their customers. This time however, the macroeconomic environment is clearly different. An upside surprise to inflation would result in higher volatility in long-duration stocks which naturally tend to be more sensitive to rate expectations.

This would have an even greater impact on RV performance given that it affects all long-duration securities – not just AI-related.