Event-driven outlook

We begin 2025 with a survey of current opportunities in Metrica’s core strategies.

Firstly, in the event-driven (hard catalyst) strategy, one of the key performance drivers is the liquidity of the target universe, as it correlates with the frequency and depth of trading opportunities.

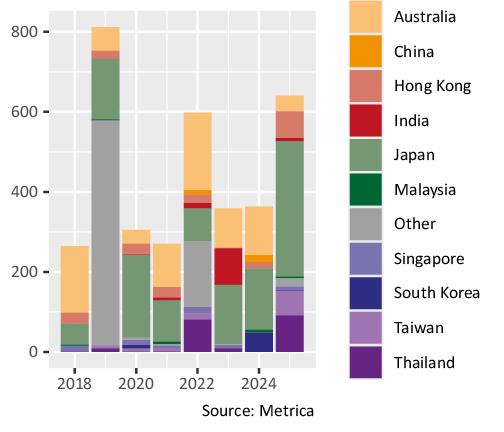

Figure 1 shows, as of the beginning of each year, the average daily turnover of M&A targets listed in Asia-Pacific (the coloured bars) or listed outside Asia-Pacific but where the acquirer is paying in shares listed in Asia-Pacific (the grey bars marked “Other”).

Figure 1: Daily liquidity of Asia-Pacific M&A deals at start of year, 2018 to date

The chart shows how daily liquidity in the Asia- Pacific M&A universe has improved to a post-2019 high of $641 million, and is 77% higher than a year ago.

Japan has driven much of the increase, which is not a surprise given sustained low-interest rates, corporate succession issues and a resurgent investor focus on balance sheet inefficiencies and governance reform. With many deals subject to upside tension from competitive bidders and/or shareholders unhappy with low-balled terms, Japan should continue to provide a key source of opportunities in the event-driven space.

Similarly, Hong Kong continues to see healthy deal activity, although in this case it is largely from major shareholders seeking to privatise companies at historically cheap valuations, with a view to relisting elsewhere. Many transactions are driven by state-owned enterprises (SOE), and in this regard we were pleased to see the recent guidelines for SOEs published by the State-owned Assets Supervision and Administration Commission (SASAC), which explicitly mention share price performance and valuation as criteria for manager evaluation. The guidelines should incentivise more SOEs to tackle the under-valuation of their Hong Kong-listed shares, creating further trading opportunities in this market.

RV outlook

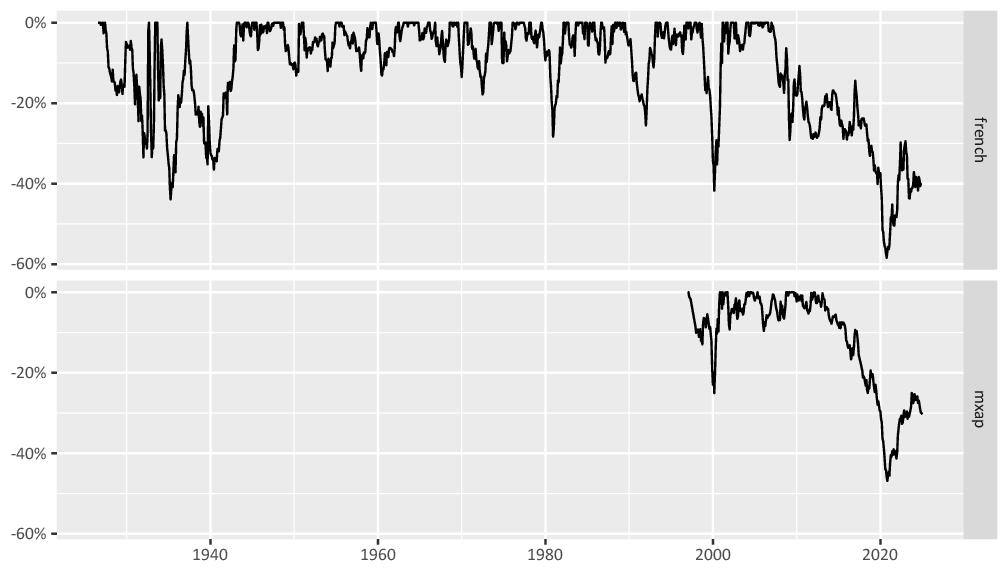

Turning to the relative value strategy, we first update the value vs. growth draw-down chart featured in past newsletters (figure 2). As a reminder, the french series is Professor Kenneth R. French’s dataset of US stocks which goes back almost one hundred years, and the mxap series is based on MSCI Asia-Pacific which has less history but which is more applicable to the fund’s core universe.

Figure 2: Draw-down from peak return for value vs. growth, 1926 to present

The chart shows the extent to which value investing (and by extension, RV investing) is or is not working4. It can be seen that, following a very steep draw-down in 2020, value has retraced around one-third of its way back to the long-term path. Longer-term, there is still around 40%+ upside to reach the 0% level.

The retracement trend paused a little over the past year as momentum factors took over. By some measures, 2024 was a record year for momentum strategies5, with the US stock market in particular posting its largest two-year gain since 1998.

While it is obviously difficult to call the top of any trend, it would be quite unusual by historical standards to see this extend into a third year. As such, the value factor may come back into favour in 2025, with positive implications for relative value strategies.

Nevertheless, given the partial retracement of value performance, does this mean that the best days are already over for RV strategies?

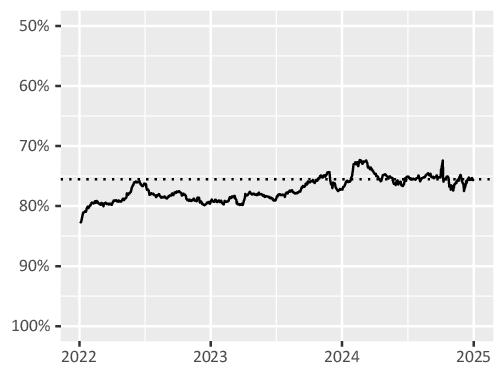

“Not at all” would be our answer. Looking at a weighted average discount to fair value for a representative sample of RV names shows how it ended 2024 at roughly the same level as it reached 30 months ago (on 17 June 2022 – dashed line in figure 3 – note the reversed axis), despite the value factor rebound.

Figure 3: Weighted average discount to fair value of sample RV names (discount compression trades), 2022 to date