Korea Exchange released the details of its long-awaited Korea Value-up index.

As expected, not one non-financial holding company was included in the index, although many listed subsidiaries were. This was not a surprise to us, as we have not seen wholehearted participation in Corporate Value-up (CVU) by any of the nonfinancial holding companies with the exception of LG Corp. We expect this to change over time following pressure by investors, regulators and the stock exchange.

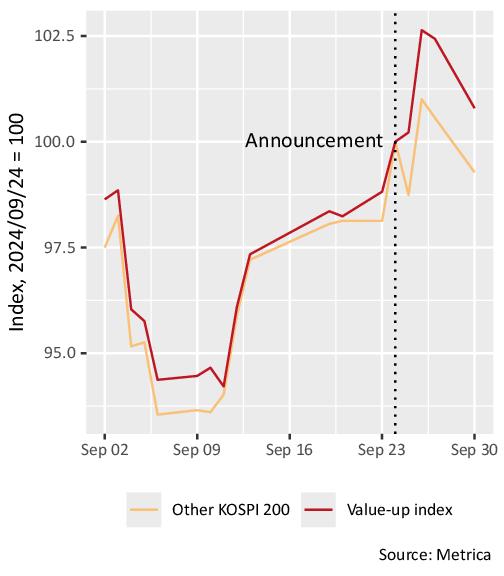

The index constituent announcement had a mild impact on the related stocks. Prior to the announcement, the performance of constituents and non-constituents was similar (figure 1). Subsequently, constituents then outperformed the others by around 2%.

Figure 1: Korea Value-up index constituent performance before and after the announcement, compared with non-constituent KOSPI 200 index members, equally-weighted

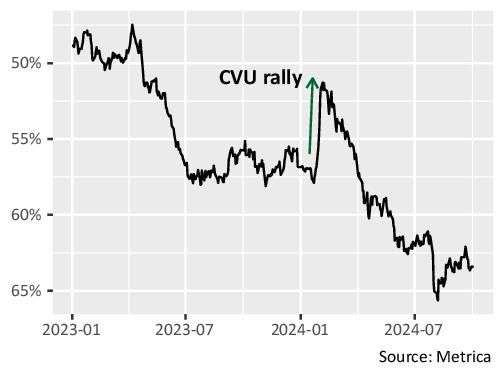

Meanwhile the valuations of listed non-financial holding companies are still pricing in very low expectations for CVU.

Figure 2 shows the discount to listed NAV (ignoring unlisted assets) of the most liquid Korean holding companies with at least 200% of market capitalisation made up of stakes in other listed companies. While discounts contracted in early 2024 thanks to the initial CVU announcements, this move was quickly reversed and the group now trades 15pp lower than it did less than two years ago.

We view this as an attractive level to be exposed to corporate governance improvements in Korea (CVU or otherwise), and the fund maintains a larger-than-normal gross exposure to the market.

Figure 2: Discount to listed assets of Korean holding companies, January 2023 to present (Includes companies trading at greater than 50% discount as of end date).