Investors in Hong Kong and mainland Chinese stocks have been waiting a long time for the market to stop falling. In April we saw the beginnings of a tentative rebound, spurred by the announcement of shareholder-friendly reforms by the China Securities Regulatory Commission and positive macro / earnings headlines, but hopes were dashed soon after as the rally lost steam.

Now we have another attempt by Hong Kong / mainland China to break out of its multi-year bear market. The catalyst seems to be a monetary stimulus package announced by the People’s Bank of China (PBOC) on 23 September. It includes:

- lowering reserve requirement ratios by 0.5pp and the main policy interest rate by 0.2pp, with further cuts possible by year-end;

- cutting mortgage rates for existing home loans by roughly 0.5pp and reducing the nationwide minimum down payment requirement for second homes from 25 percent to 15 percent, while increasing funding support for converting excess housing inventory into affordable housing; and

- supporting the stock market by allowing institutional investors to borrow liquid assets directly from the central bank to invest in equity markets, while lending to banks supporting companies to buy back their own shares.

This has had a dramatic impact on sentiment in the Hong Kong and mainland Chinese markets, causing the Hang Seng and CSI 300 indices to rally by 15.8% and 25.1% respectively from the announcement to 1 October.

Even after the rally, we still see valuations as low, at least in the Special Administrative Region. Figure 1 shows how the forward price-to-book ratio of the Hong Kong market is still not far above a twenty-year low at 1.0x.

Figure 1: Hong Kong forward price-to-book ratio, last twenty years

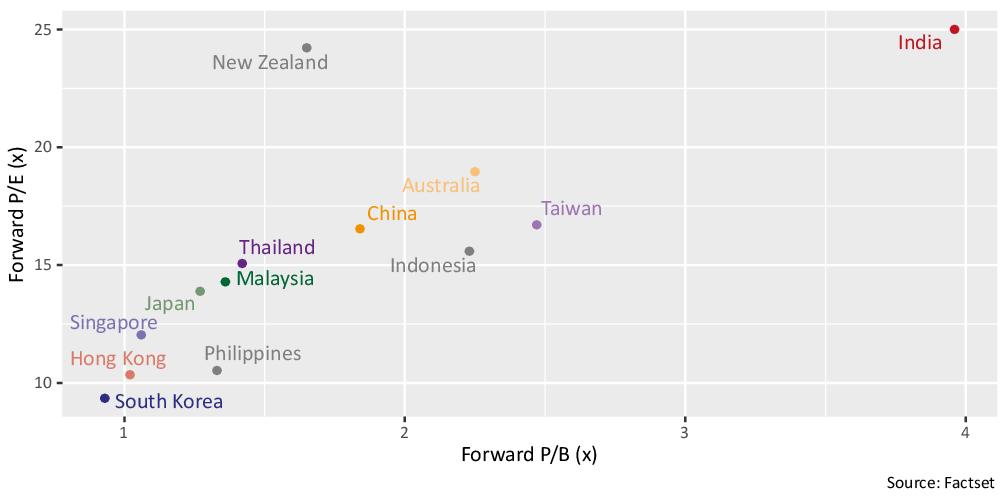

Across the region, Hong Kong is still one of the cheapest markets in terms of price-to-book and price-to-earnings ratios (figure 2) and it is significantly cheaper than mainland China.

Figure 2: Asia-Pacific market price-to-earnings and price-to-book ratios, 1 October 2024

Given the divergence in valuations between Hong Kong and the rest of the region, relative value strategies which take positions in Hong Kong versus other markets should continue to perform well if the rally continues, and the consequent volatility and dispersion should create more shorter-term trading opportunities.