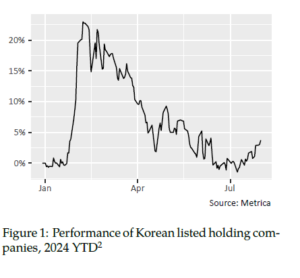

Following a period where the Korean “Corporate Value-Up” (CVU) beneficiaries retreated to below start-of-year levels, effectively pricing in a zero chance of success, the group staged a tentative, partial rebound in July (figure 1), potentially marking the start of “Round two”.

The catalyst may have been the release of CVU plans by two major banks – Shinhan and Woori – incorporating large share buybacks and multiyear shareholder return commitments. It seems that investors are happy to see concrete evidence of progress in the midst of fears over the government’s ability to implement CVU. Shinhan and Woori’s plans were well received by shareholders and highly rated by a leading Korean corporate governance think-tank.

Another encouraging data point was to be found in the 1H 2024 listed company statistics released by the stock exchange. Share buybacks increased 25% year-over-year to KRW2 trillion in the period, and share cancellations were up a staggering 191% to KRW 7 trillion.

Potentially more significant was the release of a new set of proposals – intended to rival CVU – by the opposition Democratic Party of Korea, named “Korea Booster Project”. In contrast to CVU, which incentivizes companies to act through tax incentives, the Korea Booster Project will reformthe Commercial Code to strengthen the rights of minority shareholders through:

- expanding the fiduciary duty of directors to all shareholders (not just the company);

- mandating the appointment of independent directors not influenced by controlling shareholders;

- expanding the separate election of directors who are audit committee members;

- promoting the use of cumulative voting in large corporations (which strengthens the ability of minority shareholders to elect directors); and

- implementing mandatory electronic voting and proxy solicitation for listed companies.

With both ruling and opposition parties now actively seeking to eliminate the “Korea discount”, the prospects for successful reform are significantly higher than what is priced in by the market, in Metrica’s view.

Upcoming catalysts including the “Value-up index” launch in September and creation of the associated exchange-traded fund in Q4 are likely to stimulate further interest in the theme.