We have been writing about the recovery in the performance of the Value factor since November 2020, and have since highlighted a few corners of the market which fall squarely within the Value category but which have been slow to join the trend.

Another example is the Japanese regional bank sector, which has only just started to move off its lows.

As is well known, Japanese regional banks trade at steep discounts to NAV due to 1) balance sheet volatility caused by their large portfolios of listed securities holdings, built up over the years to strengthen relationships with corporate customers, and 2) poor profitability in their core lending businesses, caused by zero / negative interest rates and sluggish loan demand.

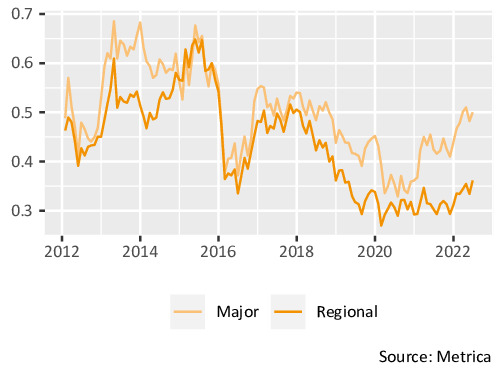

Currently the sector trades at 0.35x book, which is only slightly up from the all-time lows of around 0.30x recorded in 2020 and 2021 (figure below). Regional banks have lagged major banks since 2020 (same chart).

Japanese major and regional banks: average price-to-book (x)

Are there any specific catalysts for regional banks besides the global recovery in Value? We see four:

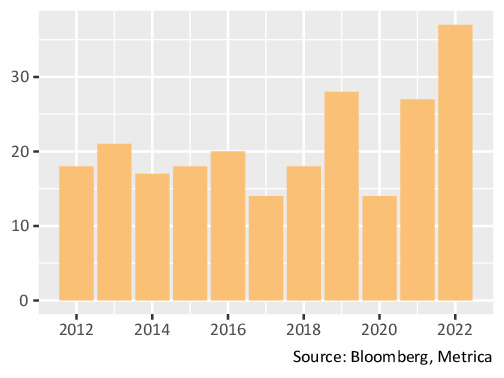

- The number of regional banks announcing share buybacks has reached at a record high (figure below). Investors have been calling for this for years, and it is finally happening. Some of the amounts are quite meaningful: for example, Yamaguchi Financial Group recently announced plans to repurchase 8.4% of outstanding shares.

Share buyback announcements by Japanese regional banks

- There has been progress on reducing listed securities holdings. The Bank of Kyoto recently announced that it would cut the book value of “policy holdings” (securities held for non-investment purposes) by 10% over three years. This should encourage other regional banks to follow suit, catching up to the major banks which have made more progress in this area.

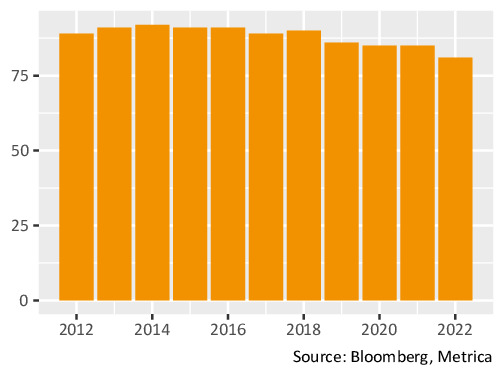

- Consolidation is a longer-term catalyst. The Ministry of Finance and Bank of Japan have created incentives for regional banks to merge, aimed at reducing over-capacity and boosting profitability. As a result, the number of regional banks has been falling gradually (figure below).

Number of listed Japanese regional banks

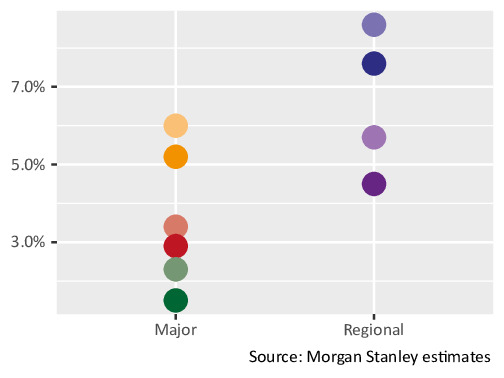

- A potential macro driver comes from the yield curve. The Bank of Japan’s insistence on keeping 10-year government bond yields below 0.25% is causing severe consequences to the Japanese economy, including a sharp depreciation of the currency at a time when global energy prices are spiking. This is unsustainable in Metrica’s view; it is likely that within the next year the BoJ will relax its policy after declaring that domestic inflation has recovered sufficiently. This will cause long-term yields to rise, which will be positive for bank earnings, all else being equal. Regional bank profits in particular are more sensitive to yield curve shifts (figure below).

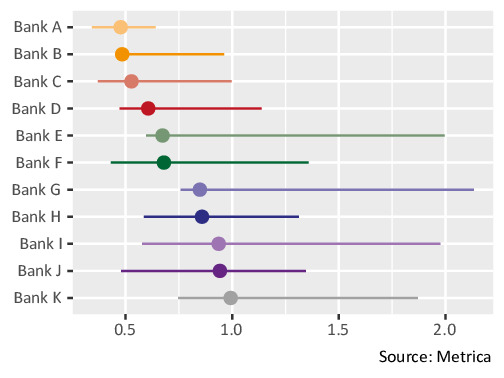

Fiscal 2023 estimated net profit sensitivity to 10 basis point parallel yield curve shift for selected Japanese major and regional banks

Higher inflation may also encourage Japanese savers to move cash out of deposit accounts and into stocks and other assets, boosting bank returns on equity through reduced capital requirements.

If the regional bank recovery is real, another point to consider is dispersion. To what extent have names been moving together?

The figure below shows a price-to-NAV chart, considering the market capitalisation of regional banks versus the mark-to-market value of their listed securities portfolios and ignoring other net assets. It can be seen that, within the overall sector move, some individual names are still close to five-year lows, while others have started to rally. The wide divergence of returns creates attractive trading opportunities for RV strategies.

Regional bank price-to-listed-NAV (x): current value and five-year range